Payment Gateway Integration (ONB03US01)

1. Problem Statement

Tenant Admin / Utility Admin:

- Many consumers prefer paying bills in cash.

- Consumers living far from collection centers avoid traveling, causing revenue loss.

- Counting and reconciling cash payments is a time-consuming and error-prone process.

CSO Admin / CSO Executive

- High cash payments make it difficult for CSO Executives / CSO Admins to manually count and reconcile payments with bills.

- Manual reconciliation increases the risk of errors, discrepancies, and delays in financial reporting.

- To access online payments, CSO teams must manually log into bank portals, download transaction reports, and cross-check payments with system records.

- The lack of automation in payment reconciliation results in time-consuming processes and inefficiencies.

- Delays in reconciling payments affect financial transparency and make reporting to higher management slower and less accurate.

Consumers:

- Consumers have to travel long distances to pay bills in cash.

- Those living in other cities or countries face difficulties in making payments.

- Lack of easy online payment options causes delays and missed payments.

Core Problem:

- The current system is slow, manual, and error-prone.

- Consumers struggle to make payments easily.

- Utility and CSO admins face challenges in tracking and reconciling payments.

- Inefficiencies lead to revenue loss and increased administrative work.

2. Who Are the Users Facing the Problem?

Users Facing the Problem

- Tenant Admin / Utility Admin

- Responsible for smooth utility operation.

- CSO Admin / CSO Executive

- Backoffice user at utility responsible for handling all consumer related issues, payments, complaints and more.

- Consumers

- End consumer who uses the utilities

- Only mentioned roles should be given access to the feature and process.

3. Jobs To Be Done

For Tenant Admin / Utility Admin:

- When I need access to accurate and timely payment data,

- But I receive delayed reports because utility workers take too long to manually count and reconcile cash payments,

- Help me streamline the payment collection and reconciliation process,

- So that I can ensure timely financial tracking, maintain systematic records, and make informed business decisions.

For CSO Admin / CSO Executive

- When I need to reconcile payments and report to higher management,

- But I have to manually count cash, download bank transactions, and cross-check them with system records, which is time-consuming and error-prone,

- Help me automate payment reconciliation and reduce reliance on manual processes,

- So that I can ensure accurate financial records, save time, and provide timely reports.

For Consumers:

- When I need to pay my utility bills,

- But I have to travel long distances or struggle to pay from another city or country,

- Help me access an easy and secure online payment option,

- So that I can pay my bills conveniently without delays or extra effort.

4. Solution

The Smart360 Online Payment System will transform the utility payment experience through a comprehensive, integrated solution:

- Payment Options

- Supports Stripe and Doku as payment gateways.

- Enables multiple payment methods (Credit/Debit Cards, Bank Transfers, Digital Wallets).

- Consumer Convenience

- Eliminates the need for physical travel to pay bills.

- Allows remote payments for consumers in different cities/countries.

- Provides instant payment confirmation and downloadable receipts.

- Bill & Service Payments

- Supports payments for multiple utilities (Water, Wastewater, Electricity).

- Allows consumers to pay multiple bills/services together or separately.

- Transaction Status & Tracking

- Displays real-time payment status (Completed, Successful, Failed).

- Sends notifications (SMS/Email/App) for transaction updates.

- Enables consumers to view and download payment receipt.

- Automated Reconciliation

- Automatically fetches and matches payments with system records.

- Reduces manual reconciliation work for back-office staff.

- Provides real-time transaction reports for utility admins.

- Revenue & Financial Management

- Eliminates revenue leakage caused by cash handling inefficiencies.

- Speeds up revenue tracking and reporting for utility admins.

- Improves financial accuracy by reducing human errors.

- Security & Compliance

- Ensures secure transactions through trusted payment gateways.

- Reduces fraud risks associated with cash handling.

- Maintains systematic financial records for audits.

- Scalability & Future Expansion

- Supports integration with additional payment providers if needed.

- Can handle large volumes of transactions without manual intervention.

- Adaptable to different regulatory and financial requirements.

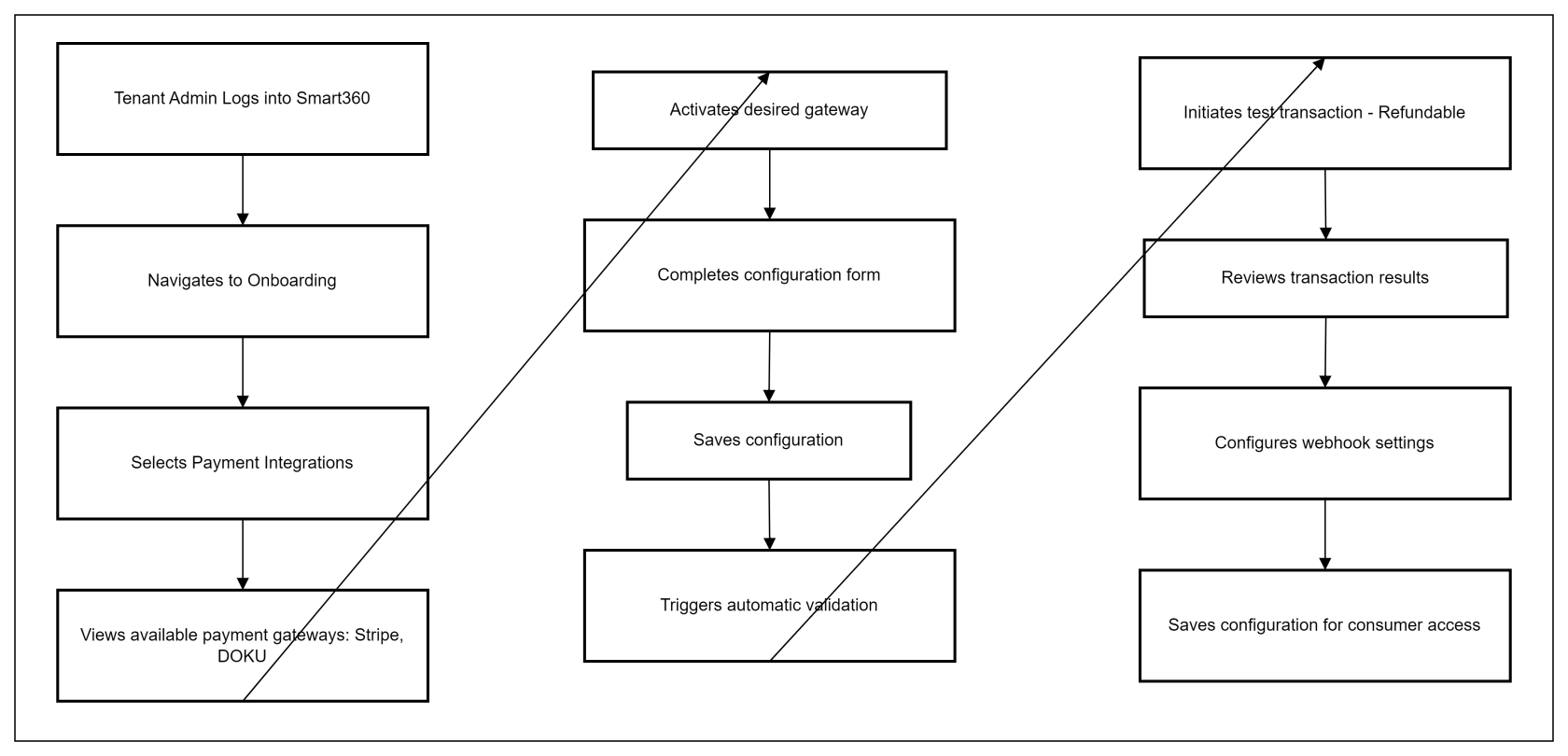

5. Major Steps Involved

For Tenant Admin:

- Tenant Admin logs into Smart360 platform using their credentials.

- Navigates to System Configuration section through the main dashboard.

- Selects "Payment Integrations" from the configuration menu.

- Views available payment gateway options (Stripe, DOKU) with current status indicators.

- Activates desired gateway by toggling the activation switch.

- Completes gateway-specific configuration form with required credentials and settings.

- Saves the configuration which triggers automatic validation of provided credentials.

- Initiates a 1 (Currency set in Onboarding) test transaction through the "Pay 1 (Currency set in Onboarding) " function which is refundable.

- Reviews transaction results showing detailed response from the live payment gateway.

- Configures webhook settings to ensure real-time transaction updates.

- Save the configuration options to make them available to utility consumers.

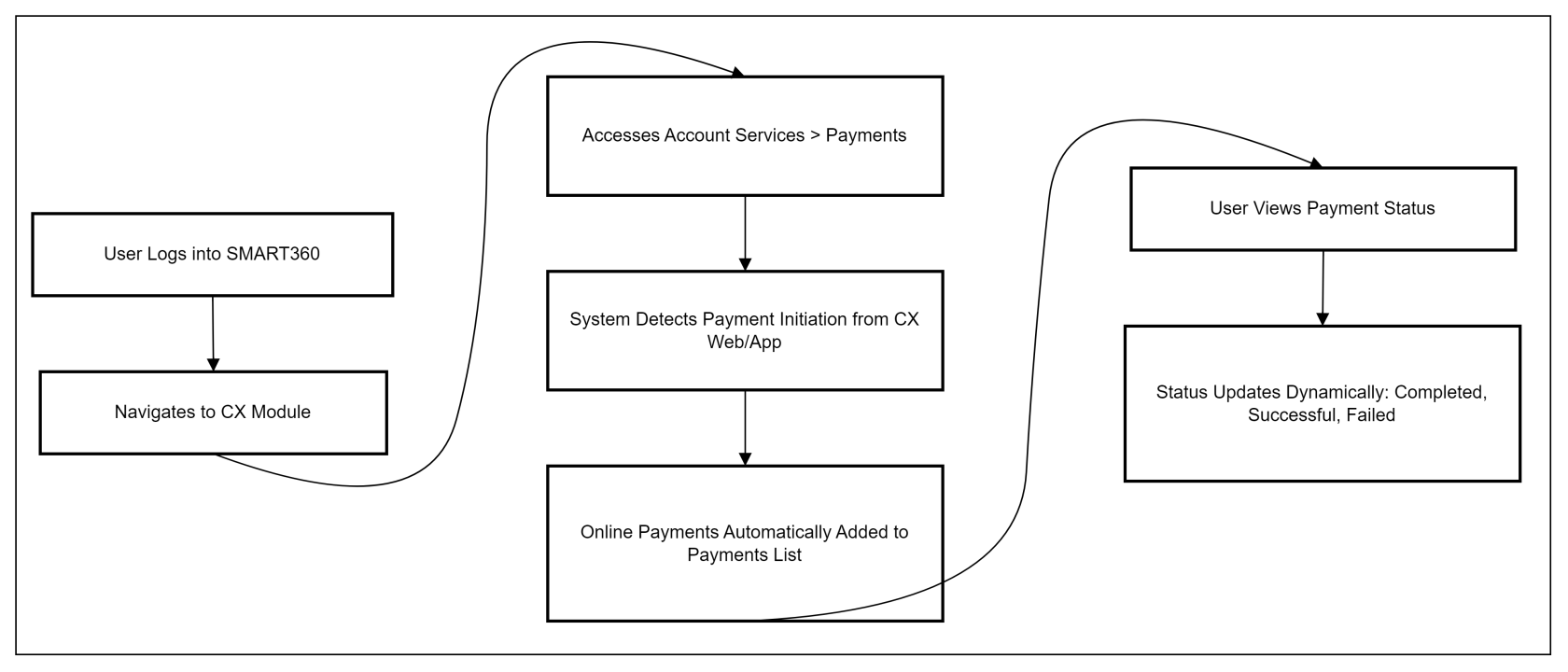

For CSO Admin / CSO Executive:

- Automatic Addition of Online Payments

- The system detects any payment initiation from CX Web or CX App.

- Online payments are automatically added to the payments list.

- User Login & Navigation

- The user logs into SMART360.

- Navigates to the CX module.

- Accesses Account Services > Payments to view the list of registered payments.

- Viewing Payment Status

- The user can view the status of online payments in the payments list.

- Status updates dynamically based on payment progress (e.g., Completed, Successful, Failed).

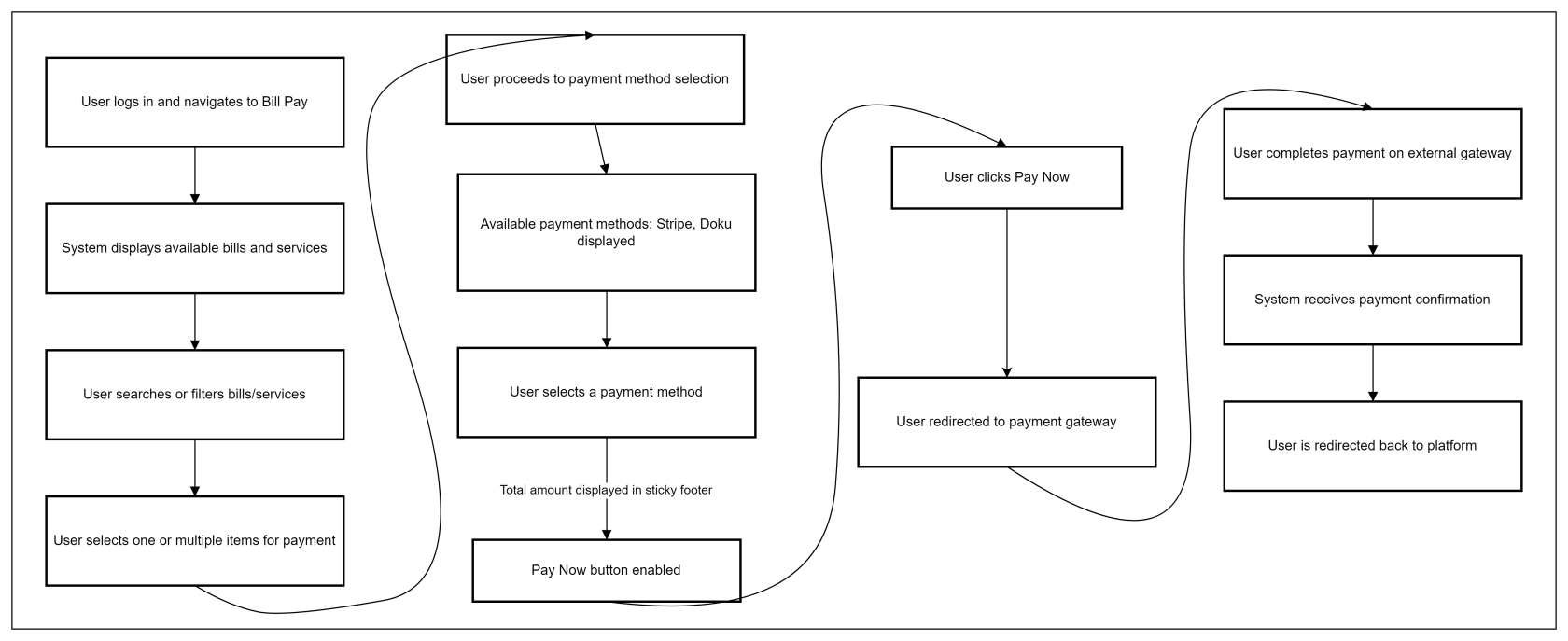

For End Consumer:

1. Bill and Service Selection

- User logs into the system and navigates to the "Bill Pay" section.

- The system displays available bills and services.

- The user can search for specific bills or services using the search bar.

- Filtering options allow users to view:

- All items

- Bills only

- Services only

- Each bill/service displays key details:

- Bill Number

- Billing Period

- Amount Due

- Service Name & Duration (for services)

- The user selects one or multiple items for payment using checkboxes.

- A "Select All" option allows bulk selection of all bills or services.

2. Payment Method Selection

- Once items are selected, available payment methods (Stripe, Doku) are displayed.

- Each payment method is shown with its logo and name.

- The user must select a payment method before proceeding.

- The total amount of selected items is displayed in a sticky footer.

- The "Pay Now" button remains disabled until a payment method is selected.

3. Payment Summary

- The selected payment method and total amount are displayed in a confirmation section.

- Users review transaction details before proceeding.

- Clicking "Pay Now" redirects the user to the selected payment gateway.

4. Payment Processing

- The system redirects the user to the external payment gateway (Stripe/Doku).

- The user completes the payment using the chosen method.

- The system receives payment confirmation and updates the status accordingly.

- The user is redirected back to the platform after payment.

Wireframes

- Tenant Admin (Onboarding) : smartpay-hub

- Consumer (CX App and Web) : billflicks

6. Flow Diagram

Tenant Admin

CSO Admin / CSO Executive

Consumer (Web and App)

7. Business Rules

General Rules:

- Payment Gateway Activation:

- System must support multiple active payment gateways simultaneously.

- At least one payment gateway must be active before the payment system can be used.

- Gateway activation status must be clearly indicated in the UI through:

- Each gateway card must display a prominent toggle switch on the right side

- Active gateways must display the toggle in blue/highlighted state

- Inactive gateways must display the toggle in gray/unhighlighted state

- When toggled from inactive to active, the system must immediately display the configuration form

- The system must visually distinguish between configured and unconfigured gateways

- Once completed the test transaction connect button should be converted to connected and disabled to click

- If the details are changed or edited later on, then the connect button should be active again.

- Once connected payment gateway handshake should be checked everyday and if any error occurs an email should be send to the tenant admin regarding the error.

- Configuration Management:

- All sensitive credentials must be stored in encrypted format, specifically:

- DOKU Gateway: Shared Key, Secret Key, API Key

- Stripe Gateway: API Key, Secret Key, Webhook Secret

- System must validate all configuration inputs before saving.

- All sensitive credentials must be stored in encrypted format, specifically:

- Testing Requirements:

- Users must complete a minimal value of 1 unit (Currency set in Onboarding) in the live environment by clicking the connect button.

- A successful transaction is required before completing gateway setup.

- When click on Pay 1 unit (Currency set in Onboarding) user should be navigated to the payment gateway to make the transaction.

- Once transaction is completed user should be returned to the platform screen form which he navigated to the gateway

- User should be able to view the transaction result on the screen,

- Payment Completed → Settlement received successfully.

- Payment Successful → Payment initiated, awaiting settlement.

- Failed → Payment not initiated due to:

- Network error

- Insufficient funds

- Technical issue

- Refund → Amount successfully refunded to the bank account

- Error Handling:

- System must provide clear, actionable error messages for failed configurations.

- Tenant Admin (Connect), Payment gateway connection "Please review all the details entered above and retry to connect"

- Tenant Admin (Connect), Payment Failed: "Display error description form payment gateway payload and display it to the user"

- Integration errors must be logged with detailed diagnostic information.

- Tenant Admins must be notified of persistent connection issues.

- If no gateway is configured end consumer shouldn't be able to view bill pay option in both CX Web and CX App.

- When user clicks on pay now and doesn't make any payment and returns back to the platform a failed transaction log should be entered.

- When end user using the payment gateway to make a payment and failed transaction then consumer should be displayed the exact error that occurred in the payment gateway in the platform too.

- System must provide clear, actionable error messages for failed configurations.

End Consumer Payment Rules:

- Payment Options:

- Only online payment mode is available for self-service.

- Both Bill and Service payments must be supported.

- Bill and Service details must be clearly displayed and fetched form the consumer account details.

- Payment Gateway Selection:

- Consumer must be able to select from available payment gateways.

- Redirect to gateway must maintain session security.

- Return from gateway must display clear success/failure messages.

- Transaction Processing:

- Transactions must be logged in account records.

- Payable and Outstanding amounts must be updated in real-time.

- Dashboard summary must reflect new payment totals.

- Once the payment is successful,

- System logs transaction in CX > Account Services > Accounts > Specific account > View > Transactions > Payments, with mode as online and status based on the status mentioned below.

- System logs transaction in CX > Account Services > Payments List, with dynamically updating status.

- A payment receipt should be available to the respective consumer to download in the payments of History tab of web or app.

- System should also log failed transactions including with the reason for failure in above mentioned flows.

- Receipts are only available after the payment is settled which is the status payment completed, until then show payment successful and it will take 2 days to complete the process.

Gateway-Specific Requirements:

Stripe Integration:

- Required Fields:

- API Key: Valid Stripe API key format (sk_live_*)

- Secret Key: Valid Stripe secret key format (rk_live_*)

- Webhook URL: Auto-generated by system, must be copied to Stripe dashboard

- Webhook Secret: Valid Stripe webhook secret format (whsec_*)

- Public Key: Valid Stripe public key format (pk_live_*)

- Currency Support: Must match tenant's configured currency

- Validation Rules:

- API Key must be validated against Stripe API before saving

- System must verify webhook functionality during setup

DOKU Integration:

- Required Fields:

- Mall ID: Numeric identifier provided by DOKU

- Shared Key: Alphanumeric security key

- Chain Merchant ID: Numeric identifier for merchant group

- API Key: DOKU-provided API access key

- Secret Key: DOKU-provided secret for signature generation

- Webhook URL: Auto-generated by system

- Currency Support: Must match tenant's configured currency

- Validation Rules:

- Mall ID must be numeric and 8 characters long

- System must validate credentials with DOKU API call

- Chain Merchant ID must be associated with the provided Mall ID

Transaction Processing Rules:

1. Bill & Service Selection Rules

- Users must be authenticated to access bill and service selection.

- The system should display only the bills and services belonging to the logged-in user.

- Selection of at least one bill or service is mandatory for proceeding to payment.

2. Payment Method Selection Rules

- Only supported payment methods (Stripe, Doku) should be displayed.

- The "Pay Now" button remains disabled until a payment method is selected.

- The total amount must be recalculated dynamically based on selected items.

3. Payment Processing Rules

- Payment initiation should redirect the user to the selected gateway securely.

- Users should be redirected back to the platform after payment completion.

- If the payment fails, the system should display an error message with retry options.

- A payment timeout should trigger a failed status if the gateway does not respond within a specified time.

4. Transaction Status Rules

The system should update the transaction status in real time based on payment outcomes:

- Payment Completed → Settlement received successfully.

- Payment Successful → Payment initiated, awaiting settlement.

- Failed → Payment not initiated due to:

- Network error

- Insufficient funds

- Technical issue

- Once the payment is successful the payment record should be logged into the following with the correct statuses

- CX > Account Services > Accounts > Particular Consumer > View > Tranasctions > Payments

- CX > Account Services > Payments

- CX Web > History > Payments

- CX App > History > Payments

- Status of the payment can be tracked here in the status column

- Once the payment is completed the bill must be cleared

5. Navigation & Error Handling Rules

6. User Interface Requirements:

- Gateway Selection:

- Available gateways must be displayed with clear visual indicators

- Active/inactive status must be immediately apparent through toggle switch color (blue for active, gray for inactive)

- Configuration forms must be hidden until gateway is toggled on

- Form Validation:

- All fields must validate in real-time with clear error messages

- Required fields must be visually indicated

- Form submission must be prevented if validation fails

- Connect:

- Connect button must be prominently displayed

- Results must show detailed gateway response

- Success/failure status must be clearly indicated with appropriate colors

7. Sample Data

- Tenant Admin

- Configuration Fields (For Stripe):

- API Key: sk_live_12hdiw7xg8sd8sd

- Secret Key: rk_live_98hsd72hsj6sda2

- Webhook Secret: whsec_182gs627hsbd8

- Public Key: pk_live_gs6dg3g672gq

- Currency: Auto fetched from onboarding

- Configuration Fields (For Doku):

- Mall ID: 12345678

- Shared Key: abcd1234xyz

- Chain Merchant ID: 87654321

- API Key: doku_key_190sd72hshd

- Secret Key: doku_secret_ks7291bdka

- Currency: Auto fetched from onboarding

- Configuration Fields (For Stripe):

- End Consumer

- Bill & Service Selection Page:

- Bill Number: BILL7890

- Billing Period: March 2025

- Amount Due: $120.50

- Service Name: Water Supply

- Payment Options:

- Stripe (Selected by Default)

- Doku

- Payment Summary:

- Selected Bill(s): BILL7890

- Total Amount: $120.50

- Selected Payment Method: Stripe

- "Pay Now" Button (Disabled Until Payment Method is Selected)

- Bill & Service Selection Page:

- CSO Admin / Executive

- Account No: CRN29391

- Name: Isidro Garcia

- Type: Services

- Amount: $120.50

- Mode: Online

- TXN ID: TXN12345

- TXN Date: 2025-03-26

- Created On: Same as TXN Date

- Created By: Same as Name

- Status: Payment Completed

8. Acceptance Criteria

- The system must allow multiple payment gateways to be active at the same time.

- At least one payment gateway must be active before any payments can be processed.

- Each payment gateway must have a toggle switch: blue for active, gray for inactive.

- When a gateway is toggled on, the system must display the configuration form.

- Users must enter valid credentials before they can activate a gateway.

- The system must store sensitive credentials in encrypted format.

- All configuration inputs must be validated before saving.

- Users must complete a 1-unit payment transaction to verify a gateway before activation.

- If the test transaction fails, users must retry before proceeding.

- Transactions must be logged in account records and update outstanding amounts in real time.

- The dashboard summary must reflect updated payment totals.

- Payment receipts must be generated only for successfully completed transactions.

- The system must update transaction statuses in real time: Completed, Successful, Failed.

- If a session expires, users must be prompted to reinitiate the process.

- Clear error messages must be displayed for failed payments.

- The Connect button must be prominently displayed.

- Success messages must be shown in green, and failure messages in red.

- When a payment is initiated from CX Web or CX App, the system must automatically detect and add it to the payments list.

- Online payments must appear in the payments list without requiring manual entry.

- Users must be able to view the status of each payment in the list.

- The system must dynamically update payment status through all stages (Completed, Successful, Failed).

9. Process Changes

- Payment Collection:

- From: Manual tracking of payments through spreadsheets and emails

- To: Automated real-time tracking through integrated payment gateways

- Impact: Reduces payment processing time and eliminates manual errors

- Reconciliation:

- From: Manual matching of payments to invoices on a weekly basis

- To: Automated real-time reconciliation as payments are processed

- Impact: Improves financial accuracy and provides daily financial clarity

- Reporting:

- From: Manual compilation of payment reports from multiple sources

- To: Automated consolidated reporting with real-time data

- Impact: Reduces reporting time from days to minutes and improves data consistency

- Error Resolution:

- From: Reactive troubleshooting after customer complaints

- To: Proactive monitoring with immediate error detection and resolution

- Impact: Reduces payment disputes and improves customer satisfaction

- Audit Preparation:

- From: Time-intensive gathering of payment records for audit

- To: Instant access to comprehensive audit trails and transaction logs

- Impact: Reduces audit preparation time and improves compliance confidence

- Gateway Management:

- From: IT-dependent configuration requiring technical expertise

- To: Self-service configuration by Tenant Admins

- Impact: Reduces implementation time from weeks to hours and empowers business users

- In-Person Payment Collection:

- From: Manual receipt generation and paper record-keeping

- To: Integrated digital payment processing with automatic receipt generation

- Impact: Reduces in-person payment processing time and eliminates paper records

- Consumer Self-Service:

- From: Phone or in-person payments requiring staff assistance

- To: Self-service web and mobile payment options

- Impact: Reduces customer support volume and improves consumer satisfaction

10. System Design Details

New Components:

- Transaction Processing Engine:

- Purpose: Manages the complete lifecycle of payment transactions

- Key Features:

- Asynchronous processing for high throughput

- Idempotent operations to prevent duplicate transactions

- Configurable workflow for different payment types

- Transaction correlation for end-to-end tracing

- Webhook Management System:

- Purpose: Handles incoming gateway notifications and events

- Key Features:

- Signature verification for security

- Event normalization across gateways

- Retry mechanisms for failed event processing

- Event logging for troubleshooting

- Consumer Self-Service Portal:

- Purpose: Provides online payment capabilities for end consumers

- Key Features:

- Bill and service payment options

- Gateway selection interface

- Payment history display

- Real-time balance updates

Affected Components:

- Tenant Admin Dashboard:

- Changes: New payment management section with configuration controls

- Integration Points: User authentication, role-based permissions

- UI Updates: Payment gateway cards, configuration forms, test controls

- Invoice Management System:

- Changes: Payment status integration, automatic reconciliation

- Integration Points: Transaction webhooks, payment status updates

- Data Flow: Bi-directional updates between invoices and payments

- Customer Experience Module:

- Changes: Payment method selection, transaction status display

- Integration Points: Payment gateway APIs, transaction status updates

- UX Improvements: Streamlined checkout process, clear payment status

- Reporting Engine:

- Changes: New payment-specific reports, dashboard widgets

- Integration Points: Transaction database, payment analytics

- New Capabilities: Cross-gateway reporting, custom payment analytics

11. Impact from Solving This Problem

High-Level Metrics Impacted:

✅ Retention -- Improves Tenant Admin satisfaction through streamlined financial processes and reduced manual work.

✅ Adoption -- Increases platform usage as users engage more frequently with the centralized payment system.

✅ User Experience -- Reduces payment-related support tickets through intuitive interfaces and automated processes.

✅ Speed -- Decreases payment processing time and reconciliation time through automation.

✅ Accuracy -- Reduces payment errors through systematic validation and automated matching.

✅ No Silos -- Eliminates information gaps between departments by providing a single source of truth for payment data.

12. User Behavior Tracking

User Behavior Tracking Plan for Payment Gateway Integration (ONB03US01)

1) Tenant Admin / Utility Admin - User Behavior Tracking Plan

Objective: Track how Tenant Admins and Utility Admins configure and manage payment gateways.

Metric | What it Tells You | Event to Track | Key Properties |

|---|---|---|---|

Payment Gateway Activated | How often a gateway is enabled | Gateway Activated | gateway_name, activation_time |

Payment Gateway Configured | If the required credentials are entered and saved | Gateway Configured | gateway_name, credentials_entered |

Payment Gateway Test Transaction | If the test transaction succeeds before activation | Gateway Test Transaction | gateway_name, test_status |

Key Insights:

- Are Tenant Admins activating and configuring payment gateways successfully?

- How frequently do they review payment reconciliation reports?

- Are test transactions being completed before activation?

2) CSO Admin / CSO Executive - User Behavior Tracking Plan

Objective: Track how CSO Admins and Executives reconcile payments and handle consumer transactions.

Metric | What it Tells You | Event to Track | Key Properties |

|---|---|---|---|

Payment Search Frequency | How often payments are searched | Payment Searched | transaction_id, search_time |

Payment Details Viewed | If payment transactions are being reviewed | Payment Details Viewed | transaction_id, consumer_id |

Payment Reconciliation Performed | If payments are matched with system records | Payment Reconciled | transaction_id, reconciliation_status |

Key Insights:

- How frequently do CSO Admins search for and validate payments?

- Are payments being reconciled on time?

3) Consumer (CX Web & CX App) - User Behavior Tracking Plan

Objective: Track consumer interactions with the online payment system.

Metric | What it Tells You | Event to Track | Key Properties |

|---|---|---|---|

Payment Initiation | How often consumers start a payment | Payment Initiated | consumer_id, payment_amount |

Payment Completion | If transactions are successful or fail | Payment Completed | transaction_id, payment_status |

Payment History Viewed | If consumers check past payments | Payment History Viewed | consumer_id, view_time |

Key Insights:

- How frequently do consumers initiate online payments?

- What percentage of payments are successfully completed?

- Are consumers checking payment history regularly?

This tracking plan will help analyze user interactions and improve the efficiency of the payment gateway integration

No Comments