Credit Notes Management (CSS01US06)

1. Problem Statement

Core Problem: Consumers currently lack visibility and management capabilities for credit notes issued by the utility, leading to confusion about account balances, missed opportunities to utilize credits, and increased customer service inquiries.

User Role: Consumer/Customer

Pain Points:

- Cannot view credit notes issued to their account, creating confusion about account balances

- No visibility into credit note details such as reason, amount, and application status

- Unable to track remaining credit balances or understand how credits are being applied

- Must call customer service to get information about credit notes, increasing wait times

- Lack of transparency in billing adjustments leads to distrust and billing disputes

2. Who Are the Users Facing the Problem?

Primary User Role: Consumer/Customer

- Utility customers who receive services and billing from the utility company

- Individuals who need to understand their account credits and billing adjustments

- Customers who want self-service access to their financial account information

Access Requirements:

- Authenticated consumers logged into their self-service portal account

- Account holders with proper verification and security clearance

3. Jobs To Be Done

For Consumer/Customer: When I need to understand my account credits and billing adjustments, but I can't see credit notes issued to my account or their details, help me view and manage all my credit notes with complete transparency, so that I can understand my account balance, track credit usage, and make informed decisions about my utility payments without having to contact customer service.

4. Solution

The proposed solution provides a comprehensive Credit Notes Management interface within the consumer self-service portal, enabling customers to view, search, and understand all credit notes associated with their account.

Key Capability Areas:

1. Credit Notes Overview Dashboard

- Comprehensive list view of all credit notes with key information

- Search and filter functionality for easy navigation

- Status indicators for active, applied, and expired credits

2. Financial Transparency

- Clear display of original amounts and remaining balances

- Usage percentage tracking for each credit note

- Applied amount visibility showing credit utilization

3. Credit Note Details Management

- Detailed view modal with complete credit note information

- Reason codes and explanations for credit issuance

- Creation date and creator information for audit trail

4. Payment Integration

- Linked payment references for traceability

- Connection between credits and specific billing periods

- Application history showing how credits were used

5. Status Management

- Real-time status updates (Active, Applied, Expired)

- Visual indicators for quick status identification

- Historical status change tracking

- Powerful search functionality across all credit note fields

- Sorting capabilities by date, amount, status, and reason

- Quick access to detailed information through intuitive UI

7. Account Balance Integration

- Integration with overall account balance calculations

- Clear indication of how credits affect total amounts due

- Remaining credit balance summaries

5. Major Steps Involved

Consumer Credit Notes Management Flow:

Step 1: Access Credit Notes

Step 2: View Credit Notes List

- Review tabular display of all credit notes

- Observe columns: Credit Note #, Amount, Remaining, Reason, Status, Created Date, Linked Payment, Actions

- Identify active credits available for use

Step 3: Search and Filter (Optional)

- Use search bar to find specific credit notes

- Apply filters by status, date range, or amount

- Sort results by preferred criteria

Step 4: Access Detailed Information

- Click on view/details icon for specific credit note

- System opens detailed modal window

- Review comprehensive credit note information

Step 5: Review Financial Details

- Examine original credit amount vs. remaining balance

- Check applied amount and usage percentage

- Understand credit utilization patterns

Step 6: Review Credit Information

- Read reason for credit issuance

- Check creation date and issuing staff member

- Review linked payment information and status

Step 7: Track Credit Application

- Monitor how credits are applied to bills

- Understand remaining balances

- Plan future payment strategies based on available credits

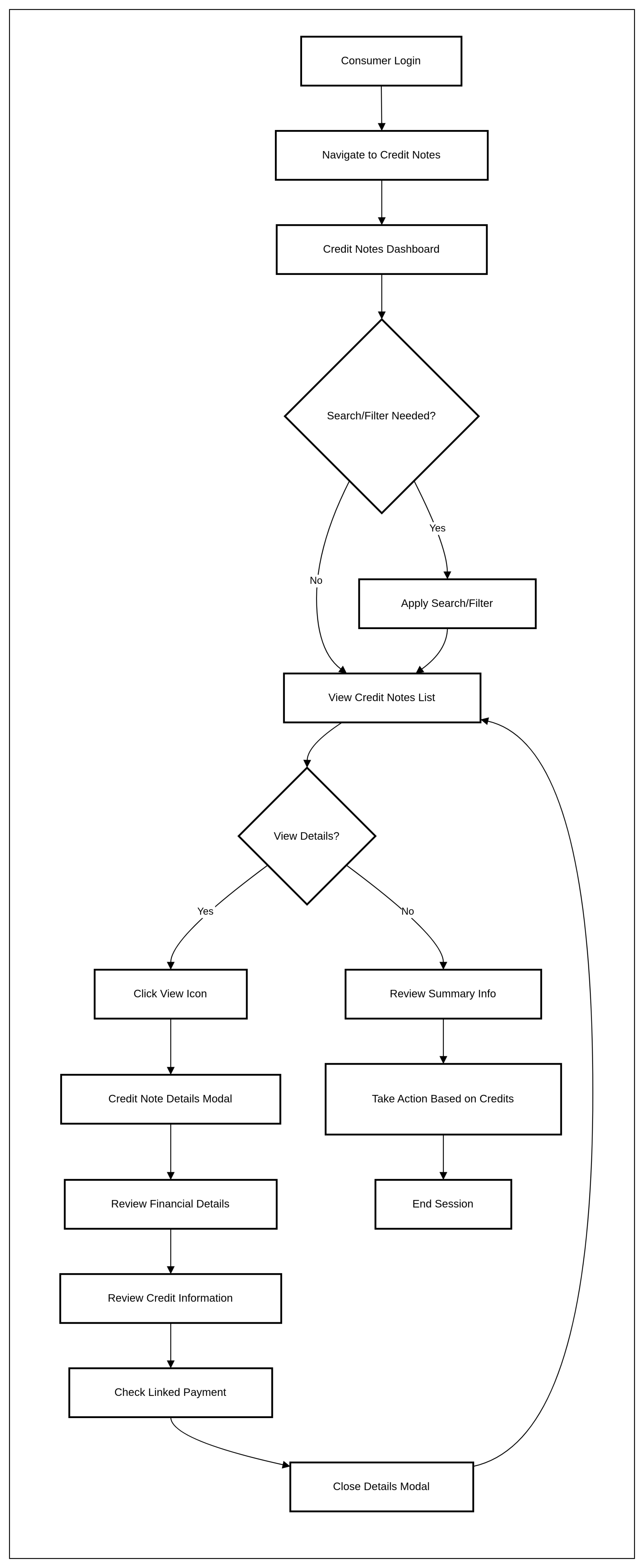

6. Flow Diagram

7. Business Rules

General Rules

- Credit notes are read-only for consumers; no modifications allowed

- Only credit notes associated with the logged-in customer's account are displayed

- All monetary amounts are displayed in the customer's billing currency

- Dates are displayed in the customer's local timezone format

Display Rules

- Credit notes are sorted by creation date (newest first) by default

- Search functionality works across all visible fields

- Status indicators use consistent color coding (Active=Blue, Applied=Green)

- Remaining balance cannot exceed original credit amount

Access Rules

- Customers can only view their own credit notes

- Audit trail is maintained for all credit note views

- Credit note details require additional authentication for sensitive information

Data Rules

- Remaining balance is calculated as Original Amount - Applied Amount

- Usage percentage is calculated as (Applied Amount / Original Amount) × 100

- Credit no

- credit applications

- date applied - when the credit note is use

- type

- refrence - bill number

- amount

- applied bypayment

- sttus

- credit applications

- date applied - when the credit note is use

- type

- refrence - bill number

- amount

- applied by

8. Sample Data

Credit Notes List Sample:

Credit Note # | Amount | Remaining | Reason | Status | Created Date | Linked Payment |

|---|---|---|---|---|---|---|

CN-10001 | $45.50 | $45.50 | Overpayment | Active | Apr 20, 2025 | R-5001 |

CN-10002 | $25.00 | $0.00 | Billing Adjustment | Applied | Apr 18, 2025 | R-5002 |

CN-10003 | $75.20 | $45.20 | Duplicate Payment | Active | Apr 15, 2025 | R-5003 |

Credit Note Detail Sample (CN-10001):

- Original Credit Amount: $45.50

- Remaining Balance: $45.50

- Applied Amount: $0.00

- Usage Percentage: 0.0%

- Reason: Overpayment

- Created By: Sarah Lee

- Linked Payment: R-5001

- Status: Active

9. Acceptance Criteria

- The system must display a comprehensive list of all credit notes associated with the customer's account

- The system must show credit note number, amount, remaining balance, reason, status, creation date, and linked payment for each entry

- The system must provide a search functionality that works across all credit note fields

- The system must allow sorting by any column in the credit notes table

- The system must display detailed information when clicking on the view/details action

- The system must show financial details including original amount, remaining balance, applied amount, and usage percentage

- The system must calculate remaining balance as (Original Amount - Applied Amount)

- The system must calculate usage percentage as (Applied Amount / Original Amount) × 100

- The system must ensure remaining balance never exceeds original credit amount

- The system must display all monetary amounts in customer's billing currency

- The system must display complete credit application history for each credit note

- The system must show date applied for each credit application instance

- The system must display application type (Bill Offset, Payment Credit, Manual Adjustment, Automatic Application)

- The system must show reference number (bill number or payment reference) for each application

- The system must display applied amount for each individual application

- The system must show "applied by" information indicating system or user who processed application

- The system must maintain chronological order of credit applications (most recent first)

- The system must use consistent status indicators with appropriate color coding (Active=Blue, Applied=Green)

- The system must update status automatically based on remaining balance (Active → Partially Applied → Fully Applied)

- The system must display creation dates in customer's local timezone format

- The system must prevent access to other customers' credit note information

- The system must maintain audit trails for all credit note access

- The system must require additional authentication for accessing sensitive credit details

- The system must maintain session security throughout credit note browsing

- The system must provide proper error handling for failed data loads

- The system must handle cases where no credit notes exist with appropriate messaging

- The system must provide responsive design for mobile and desktop access

- The system must provide clear navigation back to main account dashboard

- The system must allow filtering of credit applications by date range, type, and status

- The system must enable search within credit application history

- The system must show summary totals of applied amounts grouped by application type

- The system must validate that sum of all applied amounts does not exceed original credit amount

- The system must ensure all credit applications have valid reference numbers

- The system must maintain referential integrity between credit notes and associated bills/payments

- The system must timestamp all credit application entries with accurate date/time information

- The system must preserve complete audit trail of credit note applications

10. Process Changes

Process Area | From | To | Impact |

|---|---|---|---|

Credit Inquiry | Customers call service center to ask about credits | Customers view credits online in self-service portal | 60% reduction in credit-related calls |

Account Balance Understanding | Manual calculation or customer service explanation needed | Real-time visibility of how credits affect balances | 40% improvement in customer understanding |

Credit Tracking | No customer visibility into credit application | Full transparency on credit usage and remaining balances | 75% increase in customer satisfaction |

Billing Dispute Resolution | Multiple touchpoints to understand credit applications | Self-service access to complete credit history | 50% faster dispute resolution |

Payment Planning | Customers unaware of available credits when making payments | Informed payment decisions based on visible credit balances | 30% improvement in payment accuracy |

11. Impact from Solving This Problem

Metric Category | Improvement |

|---|---|

Customer Service Efficiency | 60% reduction in credit-related customer service calls as customers can self-serve credit information |

Customer Satisfaction | 45% increase in billing transparency satisfaction scores through complete credit visibility |

Operational Costs | 35% reduction in customer service costs related to credit inquiries and explanations |

Payment Accuracy | 30% improvement in payment accuracy as customers understand available credits |

Dispute Resolution Time | 50% faster billing dispute resolution through transparent credit information |

Customer Trust | 40% improvement in billing trust scores due to increased transparency |

Self-Service Adoption | 25% increase in overall self-service portal usage |

Account Management Efficiency | 70% improvement in customer ability to understand account financial status |

12. User Behavior Tracking

Consumer/Customer Tracking Plan:

Event | Properties | Metrics | Insights Questions |

|---|---|---|---|

credit_notes_page_view | user_id, session_id, timestamp, page_load_time | Page views, unique viewers, session duration | How often do customers check their credits? What's the engagement level? |

credit_note_search | user_id, search_term, results_count, timestamp | Search frequency, search success rate, popular terms | What credit information are customers most interested in finding? |

credit_note_details_view | user_id, credit_note_id, amount, status, timestamp | Detail view rate, most viewed credits | Which types of credits do customers want to understand better? |

credit_note_sort | user_id, sort_column, sort_direction, timestamp | Sort preferences, usage patterns | How do customers prefer to organize their credit information? |

credit_note_filter | user_id, filter_type, filter_value, timestamp | Filter usage, popular filters | What credit characteristics are most important to customers? |

session_duration_credits | user_id, session_start, session_end, pages_viewed | Average session time, bounce rate | How much time do customers spend understanding their credits? |

error_encounters | user_id, error_type, page_location, timestamp | Error frequency, error types | What problems do customers face when accessing credit information? |

Key Questions These Events Answer:

- How effectively are customers using the credit notes feature?

- What credit information is most valuable to customers?

- Are customers able to find and understand their credit details easily?

- What improvements are needed in the credit notes interface?

- How does credit visibility impact customer payment behavior?

- What are the most common customer journeys through credit information?

13. Wireframe

https://preview--consumer-self-service.lovable.app/billing

No Comments