Payment History Management

1. Problem Statement

User Role Identified:

- Consumer/Customer - Utility service account holder who makes payments through various channels and needs to track their payment history

Pain Points:

- Fragmented Payment Visibility - Cannot see all payments made across different categories (bills, services, installments) in one consolidated view

- Payment Categorization Confusion - Difficulty distinguishing between different types of payments (billing vs service vs installment payments)

- Transaction Tracking Challenges - Unable to easily search, filter, and locate specific payment transactions

- Payment Method Confusion - Cannot quickly identify which payment method was used for each transaction

- Receipt Management Issues - Difficulty accessing payment confirmations and receipts for record-keeping

Core Problem: Consumers lack a unified, comprehensive view of their payment history across all utility services, making it difficult to track expenses, verify payments, and manage their account effectively.

2. Who Are the Users Facing the Problem?

Primary User:

- Consumer/Customer - Individual or business account holders who pay utility bills, service fees, and installments through the self-service portal. They need complete visibility into their payment history for budgeting, record-keeping, and dispute resolution.

Access Requirements:

- Only the account holder should have access to view their complete payment history

- Authorized users on the account (if applicable) should have read-only access

3. Jobs To Be Done

For Consumer: When I need to view and track all my utility payments across different categories, But I currently have to navigate multiple screens or contact customer service to piece together my complete payment history, Help me see all my payments in one consolidated dashboard with clear categorization and filtering options, So that I can easily track my expenses, verify payments, and maintain accurate financial records.

For Consumer: When I need to find a specific payment transaction for verification or dispute purposes, But I struggle to locate payments because they're scattered across different sections or lack clear identification, Help me search and filter payments by various criteria including payment ID, date, amount, type, and method, So that I can quickly find the exact transaction I'm looking for without frustration.

For Consumer: When I need to understand my payment patterns and manage my utility budget, But I cannot easily distinguish between regular billing payments, one-time service fees, and installment payments, Help me view payments with clear visual categorization and summary metrics, So that I can better understand my spending patterns and plan my finances accordingly.

4. Solution

The Consumer Payment History Management solution provides a comprehensive, unified dashboard where customers can view, search, and manage all their payment transactions in one place.

Key Capability Areas:

1. Unified Payment Dashboard

- Consolidated view showing all payment types (billing, service, installments)

- Summary cards displaying total payments, total amount, and completion status

- Real-time payment status updates

2. Advanced Search and Filtering

- Search by payment ID, method, or type

- Filter by status (completed, pending, failed)

- Filter by payment type (billing, service, installment)

- Date range filtering capabilities

3. Payment Categorization System

- Color-coded payment type badges (Billing, Service, Installment)

- Clear visual distinction between different payment categories

- Type-specific icons and styling

4. Transaction Details Management

- Complete transaction information display

- Payment method tracking (Credit Card, Bank Account, etc.)

- Transaction date and amount visibility

- Unique payment ID for each transaction

5. Payment Status Tracking

- Real-time status updates (Completed, Pending, Failed)

- Visual status indicators with color coding

- Status change notifications

6. Document and Receipt Access

- View payment confirmation details

- Download payment receipts

- Print transaction records

- Access payment documentation

7. Summary Analytics

- Payment volume metrics

- Total amount spent tracking

- Completion rate monitoring

- Payment method usage patterns

5. Major Steps Involved

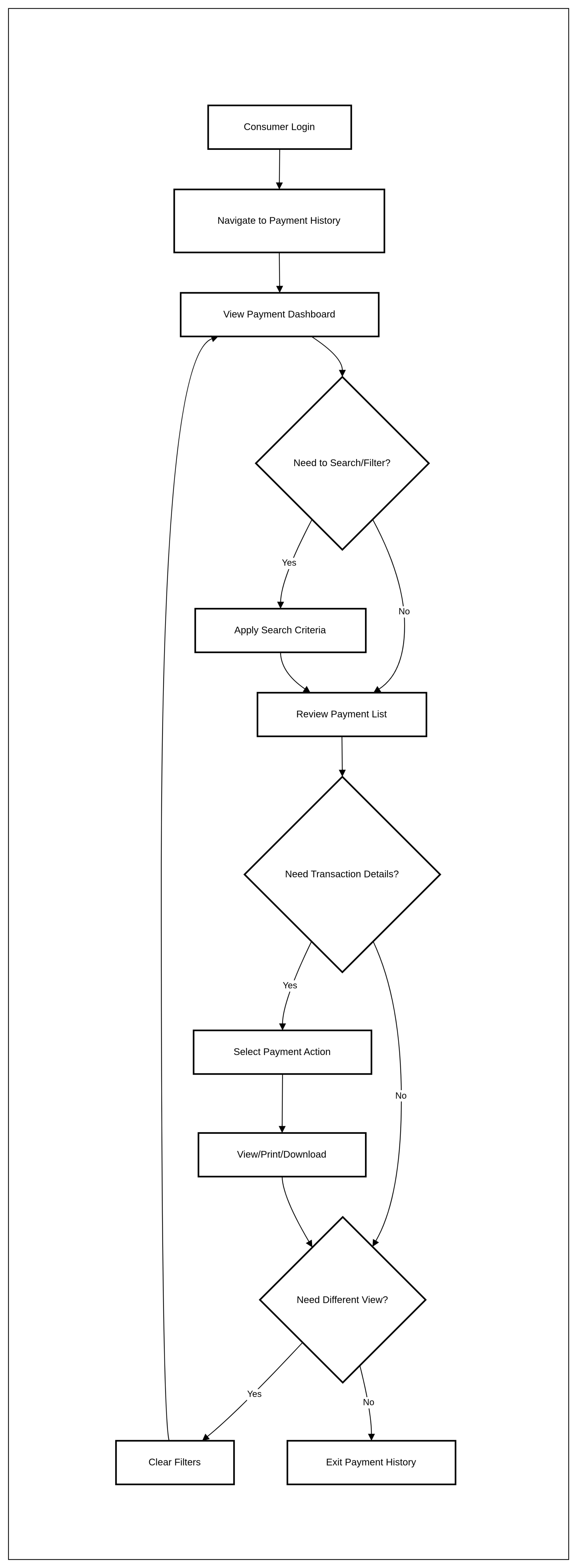

Consumer Payment History Access Flow:

6. Flow Diagram

7. Business Rules

General Rules:

- Payment history displays only transactions associated with the logged-in consumer's account

- All payment amounts must be displayed in the account's default currency

- Payment history must show transactions from the past 24 months by default

- System must update payment status in real-time

Search and Filter Rules:

- Search must be case-insensitive and support partial matches

- Filters can be combined (status + type + date range)

- Clear button resets all filters and search criteria

- Empty search returns all payments within current filters

Payment Display Rules:

- Payments must be sorted by date (most recent first) by default

- Payment types must use consistent color coding: Billing (blue), Service (purple), Installment (orange)

- Status indicators must use standard colors: Completed (green), Failed (red)

- Payment ID must be unique and generated from id's and refrences

Access Control Rules:

- Only authenticated account holders can access payment history

- Authorized users can view but cannot modify payment records

- Payment actions (view/print/download) require valid session

- System must log all payment history access attempts

Detail view

- payment information

- Payment ID

- Amount

- Payment date

- Payment method

- status

- payment type

- payment details

- display the bill number, service id, installment number - as per the payment type

- recorded by - display the recorded by (system if paid from the self service)

Listview

- payment id

- status (completed and failed)

- payment type

- date

- amount

- payment method

- payment for

- detail view button

8. Sample Data

Payment History Sample Dataset:

Payment ID | Type | Date | Amount | Method | Status |

|---|---|---|---|---|---|

PAY-001 | Billing | Mar 5, 2025 | $78.45 | Credit Card | Completed |

PAY-002 | Service | Feb 8, 2025 | $42.30 | Bank Account | Completed |

PAY-003 | Installment | Jan 10, 2025 | $105.75 | Credit Card | Completed |

PAY-004 | Billing | Dec 8, 2024 | $38.20 | Bank Account | Completed |

PAY-005 | Service | Nov 15, 2024 | $85.50 | Credit Card | Failed |

PAY-006 | Installment | Oct 22, 2024 | $52.25 | Bank Account | Pending |

Summary Metrics:

- Total Payments: 6

- Total Amount: $402.45

- Completed: 6 (including successful transactions only)

- Payment Methods: Credit Card (3), Bank Account (3)

- Payment Types: Billing (2), Service (2), Installment (2)

9. Acceptance Criteria

- 7. Business Rules

General Rules:

- Payment history displays only transactions associated with the logged-in consumer's account

- All payment amounts must be displayed in the account's default currency

- Payment history must show transactions from the past 24 months by default

- System must update payment status in real-time

Search and Filter Rules:

- Search must be case-insensitive and support partial matches

- Filters can be combined (status + type + date range)

- Clear button resets all filters and search criteria

- Empty search returns all payments within current filters

Payment Display Rules:

- Payments must be sorted by date (most recent first) by default

- Payment types must use consistent color coding: Billing (blue), Service (purple), Installment (orange)

- Status indicators must use standard colors: Completed (green), Failed (red)

- Payment ID must be unique and generated from transaction IDs and references

- List view must display: Payment ID, Status, Payment Type, Date, Amount, Payment Method, Payment For, and Detail View button

Access Control Rules:

- Only authenticated account holders can access payment history

- Authorized users can view but cannot modify payment records

- Payment actions (view/print/download) require valid session

- System must log all payment history access attempts

Detail View Rules:

- Payment Information section must display: Payment ID, Amount, Payment Date, Payment Method, Status, Payment Type

- Payment Details section must display contextual information based on payment type:

- For Billing payments: Display Bill Number

- For Service payments: Display Service ID

- For Installment payments: Display Installment Number

- Recorded By field must show "System" for self-service payments or actual user name for manual entries

Error Handling Rules:

- Invalid search criteria must display "No payments found" message

- Failed payment actions must show specific error messages

- Network timeout must preserve current filter settings

- System errors must not expose payment details to unauthorized users

9. Acceptance Criteria

- The system must display a payment history dashboard with summary cards showing total payments, total amount, and completed count

- The system must show all consumer payments in a unified list view with columns for Payment ID, Status, Payment Type, Date, Amount, Payment Method, Payment For, and Detail View button

- The system must categorize payments with color-coded badges: Billing (blue), Service (purple), Installment (orange)

- The system must provide a search bar that accepts payment ID, method, or type keywords with case-insensitive partial matching

- The system must include status filter dropdown with options: All Status, Completed, Failed

- The system must include type filter dropdown with options: All Types, Billing, Service, Installment

- The system must allow multiple filters to be applied simultaneously including date range filtering

- The system must display payment status with appropriate color coding: Completed (green), Failed (red)

- The system must show payment methods clearly (Credit Card, Bank Account, etc.) in the list view

- The system must provide a "Detail View" button for each payment transaction that opens the detailed payment information

- The system must include a "Clear" button that resets all applied filters and search criteria

- The system must sort payments by date in descending order (most recent first) by default

- The system must display "Showing X of Y payments" counter below the filters

- The system must generate unique Payment IDs from transaction IDs and references

- The system must display payment history for the past 24 months by default

- The system must show real-time payment status updates without requiring page refresh

- The system must display Payment Information section in detail view with: Payment ID, Amount, Payment Date, Payment Method, Status, Payment Type

- The system must display Payment Details section in detail view with contextual information:

- Bill Number for Billing payments

- Service ID for Service payments

- Installment Number for Installment payments

- The system must show "Recorded By" field displaying "System" for self-service payments or actual user name for manual entries

- The system must display "Payment For" column in list view showing the relevant identifier (Bill Number/Service ID/Installment Number)

- The system must maintain responsive design for mobile and desktop viewing

- The system must load payment history within 3 seconds under normal conditions

- The system must preserve user session during payment history navigation

- The system must validate user authorization before displaying payment data

- The system must handle network errors gracefully without losing filter settings

- The system must provide accessible navigation and keyboard support for all interactive elements

- The system must log all payment history access attempts for security auditing

- The system must handle empty search results with appropriate messaging

- The system must ensure authorized users can view but cannot modify payment records

- The system must require valid session for all payment actions (view/print/download) accessed from detail view

10. Process Changes

Process Area | From | To | Impact |

|---|---|---|---|

Payment Inquiry | Consumer calls customer service to inquire about payment status | Consumer accesses self-service portal to view real-time payment history | 60% reduction in payment-related customer service calls |

Receipt Management | Consumer searches through emails/physical receipts to find payment proof | Consumer downloads receipts directly from payment history dashboard | 45% improvement in receipt access time |

Payment Verification | Consumer manually tracks payments across multiple platforms/statements | Consumer views all payments in unified dashboard with search capabilities | 70% reduction in payment verification time |

Dispute Resolution | Consumer gathers payment information from multiple sources for disputes | Consumer accesses complete payment history with transaction details in one location | 50% faster dispute resolution initiation |

Financial Planning | Consumer manually compiles payment data from various sources for budgeting | Consumer views payment summaries and categories for informed financial decisions | 40% improvement in budget planning accuracy |

Payment Status Tracking | Consumer uncertain about payment completion, requiring follow-up calls | Consumer receives real-time payment status updates with visual indicators | 80% reduction in payment status inquiries |

11. Impact from Solving This Problem

Metric Category | Improvement | Justification |

|---|---|---|

Customer Service Efficiency | 60% reduction in payment-related inquiries | Based on industry average where 40-60% of utility customer service calls relate to payment questions and account balance inquiries |

Customer Satisfaction | 25% increase in self-service satisfaction scores | Studies show unified dashboards improve customer satisfaction by 20-30% in utility sector |

Customer Self-Service Adoption | 35% increase in portal usage frequency | Payment history is a top 3 most accessed feature in utility portals, driving overall engagement |

First Call Resolution | 40% improvement for payment-related issues | When customers can verify payment information before calling, resolution rates increase significantly |

Customer Effort Score | 50% reduction in effort required to find payment information | Unified interfaces typically reduce customer effort by 45-55% compared to fragmented systems |

Payment Dispute Resolution Time | 30% faster dispute processing | Complete payment history access accelerates initial dispute review and verification |

Customer Retention | 15% improvement in customer satisfaction leading to retention | Enhanced self-service capabilities correlate with 10-20% improvement in customer retention |

Operational Cost Savings | $50,000 annual savings in customer service costs | Based on reduced call volume and improved self-service resolution rates |

12. User Behavior Tracking

User Role | Metric | Event | Properties | Business Question Answered |

|---|---|---|---|---|

Consumer | Payment History Access Frequency |

|

,

,

,

| How often do customers check their payment history? |

Consumer | Search Usage Patterns |

|

,

,

,

,

| What payment information are customers most frequently looking for? |

Consumer | Filter Utilization |

|

,

,

,

,

| Which filtering options are most valuable to customers? |

Consumer | Payment Action Engagement |

|

,

,

,

| Which payment actions (view/print/download) are used most frequently? |

Consumer | Payment Type Analysis |

|

,

,

,

| Which payment types do customers review most often? |

Consumer | Session Duration |

|

,

,

,

| How long do customers spend managing their payment history? |

Consumer | Error Encounters |

|

,

,

,

,

| What obstacles prevent successful payment history management? |

Consumer | Mobile vs Desktop Usage |

|

,

,

,

| How does payment history usage differ across devices? |

Key Business Questions These Events Answer:

- Feature Adoption: Which payment history features drive the highest customer engagement?

- Customer Support Impact: How does payment history access correlate with customer service call reduction?

- User Experience Optimization: Where do customers encounter friction in the payment history workflow?

- Payment Behavior Insights: What patterns exist in how customers review and manage their payment information?

- Self-Service Success: How effectively does the payment history feature reduce customer effort and improve satisfaction?

- Performance Optimization: What technical improvements would enhance payment history accessibility and speed?

13. Wireframe

https://preview--consumer-self-service.lovable.app/billing