Payments Management (CIS01US09)

1. Problem Statement

User Roles Identified:

- Billing Manager - Oversees payment processing and revenue management

- Recovery Executive - Manages collections and payment arrangements

- Customer Executive - Processes customer payments at service centers

Pain Points by User Role:

Billing Manager:

- Cannot efficiently track payment plan compliance and performance

- Limited visibility into payment trends and collection effectiveness

- Insufficient reporting capabilities for revenue analysis

- Manual processes for payment reconciliation across channels

- Difficulty in identifying payment pattern anomalies

Recovery Executive:

- Unable to record payments against specific payment arrangements

- No integrated view of payment plan status and compliance

- Lack of automated alerts for missed payment plan installments

- Manual tracking of payment arrangement terms and conditions

- Difficulty in coordinating payment plans with disconnection schedules

Customer Executive:

- Limited payment detail view when assisting customers

- Cannot access comprehensive payment history during interactions

- Insufficient information about payment plan terms during customer visits

- No ability to modify payment arrangements during customer service

- Lack of real-time payment posting visibility

Core Problem:

The current payments management system lacks comprehensive functionality for payment plan management, detailed payment tracking, and integrated customer service capabilities, resulting in inefficient revenue collection, poor customer experience, and limited visibility into payment performance metrics.

2. Who Are the Users Facing the Problem?

Billing Manager

- Responsible for overall payment processing operations and revenue management

- Needs comprehensive payment analytics and reporting capabilities

- Requires oversight of all payment channels and methods

Recovery Executive

- Manages delinquent accounts and payment arrangement negotiations

- Needs ability to create, track, and manage payment plans

- Requires automated alerts and compliance monitoring tools

Customer Executive

- Handles in-person payment processing and customer inquiries

- Needs detailed payment information for customer service interactions

- Requires ability to process various payment types and arrangements

3. Jobs To Be Done

For Billing Manager: When I need to analyze payment performance and revenue trends across all channels, but I lack comprehensive reporting tools and real-time analytics, help me access integrated payment dashboards with drill-down capabilities and automated performance metrics, so that I can make data-driven decisions about collection strategies and identify revenue optimization opportunities.

For Recovery Executive: When I need to create and manage payment arrangements for delinquent customers, but I cannot record payments against specific payment plans or track compliance automatically, help me establish structured payment plans with automated tracking and alert systems, so that I can improve collection rates and reduce the time spent on manual payment plan administration.

For Customer Executive: When I need to assist customers with payment inquiries and process various payment types, but I lack detailed payment history and real-time transaction capabilities, help me access comprehensive payment details and streamlined processing tools, so that I can provide superior customer service and resolve payment-related issues efficiently during customer interactions.

4. Solution

Comprehensive Payment Management Platform Enhancement

Key Capability Areas:

1. Enhanced Payment Dashboard & Analytics

- Real-time payment performance metrics with customizable KPI tiles

- Interactive charts and graphs for payment trends analysis

- Comparative period analysis with percentage change indicators

2. Payment Plan Management System

- Automated payment plan compliance monitoring

- Integration with disconnection/reconnection workflows

3. Advanced Payment Processing

- Multi-channel payment recording with automatic categorization

- Real-time payment posting and confirmation

- Support for partial payments and overpayment handling

4. Detailed Payment History & Tracking

- Comprehensive payment timeline with transaction details

- Payment method tracking and performance analysis

- Customer payment behavior pattern recognition

5. Customer Service Integration

- 360-degree payment view during customer interactions

- Quick payment processing tools for customer service staff

- Payment dispute management and resolution tracking

6. Automated Alerts & Notifications

- Payment plan compliance alerts and reminders

- Collection milestone notifications

- Payment processing error alerts and resolution workflows

8. Credit Notes & Adjustments Management

- Streamlined credit note creation and application

- Automated adjustment workflows with approval controls

- Credit balance management and application tracking

9. Payment Reconciliation Tools

- Automated bank reconciliation with exception handling

- Multi-channel payment matching and verification

- Discrepancy identification and resolution workflows

10. Mobile Payment Processing

- Field payment collection capabilities for service technicians

- Mobile payment plan setup and modification

- Real-time payment confirmation and receipt generation

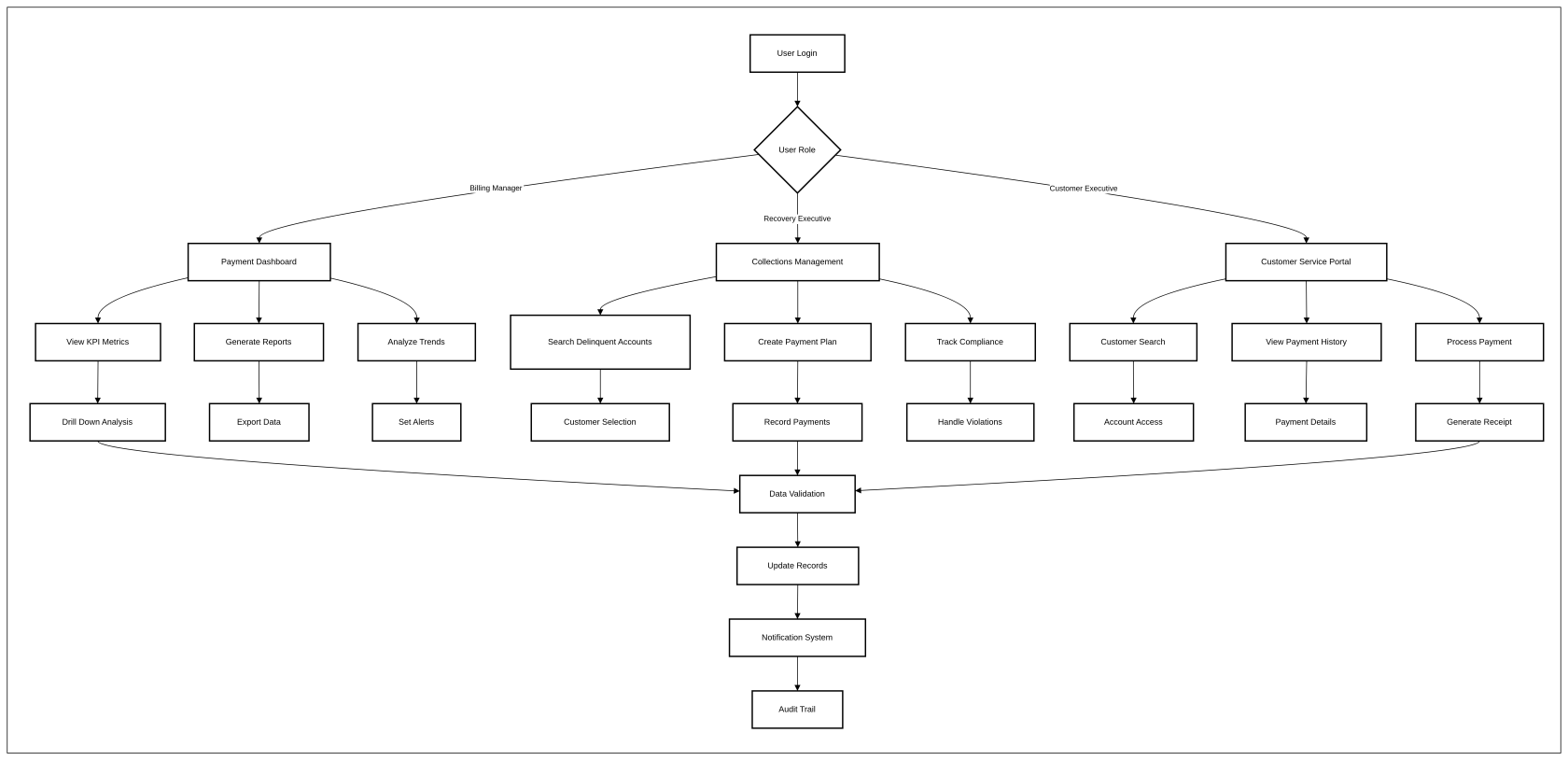

5. Major Steps Involved

Billing Manager Flow:

- Access enhanced payments dashboard from main navigation

- Review real-time payment performance metrics and KPI tiles

- Drill down into specific payment channels or time periods

- Generate custom reports using advanced filtering options

- Analyze payment trends using interactive charts and graphs

- Export data for external analysis or regulatory reporting

- Set up automated alerts for payment performance thresholds

- Review and approve payment adjustments and credit notes

Recovery Executive Flow:

Customer Executive Flow:

- Access customer account through unified customer search

- View comprehensive payment history and current balance status

- Process customer payment using integrated payment processing tools

- Apply payments to specific bills or payment plan installments

- Generate payment confirmation and receipt for customer

- Handle payment disputes using integrated resolution tools

- Set up or modify payment arrangements during customer visit

- Document customer payment preferences and special circumstances

6. Flow Diagram

7. Business Rules

General Rules:

- All payment transactions must be recorded with timestamp and user identification

- Payment amounts cannot exceed outstanding balance plus allowable overpayment threshold

- Credit balances must be clearly identified and managed according to utility policies

- All payment modifications require appropriate authorization levels

Record Payment form

Search consumer

- Consumer can be serach by name , account number

- after consumer is selected then the account details should be displyed

channel selection

- channels added in setting should be vissible - bydefault walkin channel is selected

Payment Type Business Rules

Payment Classification

- System must categorize payments into distinct types (Bill, Service, Installment)

- Each payment type follows different processing workflows

Bill Selection, Service selection and installation selection

- In bill payment - diplay the current bill of the consumer

- in service paymenmts - display the un paid service

- Installments - display all the unpaid installmets

Payment Method Rules

- Payment methods will come from the settings > payments mode

Payment summary

- Display the payments summary, payment amount, method

- Display the outstanding or extra amount paid by the consumer

Additional Notes

- user can add additional notes

Review and confirm

- Display the the account summary - consumer name, account and current balance(outstanding)

- Payment summary - payment type, payment channel, payment method, total amount, recorded by.

Proccessing payments

- an payment reciept should be generated on the submission. include all the payments details

- reciept can be downloded, printed.

- record another payment option should be available

- return to dashboard - redirect to dashboard

Payments details view

Payment information

- Payment id - generated from num format

- status - payment status , if recorded by the user then mark as posted and for online refer below

- Payment gateways use different status terminology that we standardize in our system:

- Settlement Status Mapping

- Amount paid - amount that is paid during the payment

- payment method

- payment type

- channel

Payments details (according to the payment type selected)

- bill - invoice id, service period

- service - service name , service date

Payment amount analysis (according to the payment type selected)

- bill - billed amount, Amount paid, difference (exact payment, over paid, under paid)

- Service - Service amount, amount paid, difference (exact payment, over paid, under paid)

- Installment - installment amount, amount paid, difference (exact payment, over paid, under paid)

Credit note generated - if extra amount is paid

- Generate a credit note if extra payment is paid

- can view creditnote

- credit note number

- credit amount

Cash payments details - only if method is cash

- Amount recieved

- change given

Transaction information

- transaction ID - from num format

- receipt number - from num format

- payment date

Processing informationm

- Recieved by - if recorded by the user then display user name otherrwise display system for online transactions

- processing time - immediate for payment recorded rom the user. calculate the processing time for online payment in days.

- Verification - if recorded by user the marked verified , if online then mark pending unless verified, give a verify buttone under the processing information section

Consumer information

- consumer name

- Account number

- Service address

- phone

Landing page

Header KPIs

- Total Collected

- Must show the cumulative payment amount for the selected month (e.g., April 2025).

- Updates automatically based on all posted payment transactions.

- Received Today

- Displays today’s total received payment amount and transaction count.

- Should include only transactions posted on the current date.

- Collection Rate

- Calculated as

(Total Collected / Total Due) × 100. - Only includes posted payments for the selected period (e.g., April 2025).

- Calculated as

- Avg Collection Time

- Represents the average number of days between bill/service generation and payment date.

- Includes only posted payments for April 2025.

Tabs

- All Payments Tab

- Default selected tab.

- Displays all recorded and posted payments.

- Includes filters, search, and list of transactions.

- Credit Notes Tab

- Displays only credit note-related entries.

- Should support similar filters and search as All Payments.

Filters and Search

- Search Payments

- Allows text-based search across consumer name, receipt number, or consumer ID.

- Must be case-insensitive and support partial matches.

- Filters (Dropdown/Advanced Filters, assumed from UI)

- Should allow filtering by:

- Date Range

- Payment Method (Cash, Credit Card, etc.)

- Payment Status (Posted, Pending)

- Type (Bill, Service)

- Should allow filtering by:

Payment Table Fields

- Receipt #

- Unique identifier prefixed (e.g., R-5001).

- Clickable link should open detailed receipt view.

- Must be system-generated.

- Consumer

- Displays consumer full name and ID.

- Clicking consumer name may redirect to the consumer profile.

- Amount

- Represents the amount received for the transaction.

- Should be formatted with 2 decimal places and currency symbol.

- Method

- Displays payment mode: Cash, Credit Card, Bank Transfer, etc.

- Must be selected from predefined options when recording payment.

- Date

- Shows the date when the payment was recorded.

- Should be shown in local or utility-configured format.

- Type

- Defines the category: Bill (utility bills) or Service (other payments like reconnection charges) or installment

- Must be selected while recording a payment.

- Status

- Indicates the posting state of the payment.

- "Posted" status means finalized and reflected in metrics.

- Other possible statuses (not shown): Pending, Failed, Cancelled.

- More Actions (Three Dots)

- Allows actions like:

- View details

- View Receipt

- Create credit note

- view payment

- Allows actions like:

- Opens a form to manually record a new payment.

- Must include validations for mandatory fields (amount, method, type, consumer, date).

- Should restrict editing posted payments unless user has admin rights.

Create credit note

Payment Details (Read-only Block)

- Consumer Name

- Display the name of the consumer associated with the original payment.

- Must match the selected payment record.

- Account Number

- Show the consumer’s unique account number.

- Must be fetched from the payment record.

- Receipt Number

- Show the receipt number from which the credit note is being generated.

- Must be unique and non-editable.

- Payment Amount

- Total amount paid in the original transaction.

- Used to define the maximum credit amount.

- Payment Date

- Show the date of the original payment for audit purposes.

- Payment Method

- Display the mode of payment (e.g., Cash, Credit Card).

- Must be inherited from the original payment record.

Credit Note Details

- Credit Note Number

- Auto-generated in a sequential format from the num format (e.g., CN-46129).

- Must be unique across the system.

- Credit Amount

- Defaulted to full payment amount.

- Business Rule: Cannot exceed the original payment amount.

- Must allow decimal inputs (2 decimal places).

- Validation: Show max limit hint (e.g., “Maximum: $145.50”).

- Reason for Credit Note

- Dropdown field with predefined reasons (e.g., Overpayment, Duplicate Payment, Billing Error, billing adjustment, refund request, customer request , other).

- Mandatory field.

- Selection should be logged for audit tracking.

- Remarks (Optional)

- Free-text field for internal notes.

- Max character limit should be enforced (e.g., 500 chars).

- Not mandatory, but shown in audit trail and reports if filled.

Summary Information (Auto-calculated)

- Original Payment Amount

- Always equals the payment made under the selected receipt.

- Credit Note Amount

- Reflects the entered value in the “Credit Amount” field.

- Remaining Payment Value

- Calculated as:

Original Payment Amount – Credit Note Amount. - Must not be negative.

- If equal to 0, indicates full reversal.

- Calculated as:

- Cancel

- Discards the operation and closes the dialog.

- No data is saved.

- Create Credit Note

- Active only if:

- Credit Amount > 0 and ≤ Original Payment Amount

- Reason is selected

- Triggers:

- Credit Note generation

- Should show success/failure toast on action completion.

- Active only if:

Credit notes tab

Search

- Search credit notes…

- Supports searching by:

- Credit Note #

- Consumer Name

- Consumer Account Number

- Linked Receipt Number

- Case-insensitive and supports partial matches.

- Supports searching by:

Table Columns and Business Rules

- Credit Note #

- Must be unique

- Clickable to open full credit note detail view.

- Consumer

- Shows consumer name and unique ID.

- Click may redirect to the consumer profile (optional behavior).

- Amount

- Total credited amount for the note.

- Always shown in currency format with 2 decimal places.

- Remaining

- Remaining credit available to be applied.

- Calculation:

Amount - Applied Credit - If $0.00 → Status should switch to "Applied"

- Reason

- Predefined tags like Overpayment, Duplicate Payment, Billing Adjustment.

- Shown as pill-style badges.

- Should be stored from the "Create Credit Note" screen.

- Status

- Active: Credit is partially/fully unused.

- Applied: Entire credit amount has been used.

- Changes automatically based on the remaining credit.

- Created Date

- Date the credit note was generated.

- Must match the credit note transaction log timestamp.

- Linked Payment

- Clickable receipt number linking the credit note to the original payment.

- Mandatory for audit trail and reconciliation.

3-dot (More Options) Actions

- View Details

- Opens full details of the credit note in view-only mode.

- Print Credit Note

- Generates a printable PDF format of the credit note.

- Includes header, consumer, amount, reason, and system stamp.

- View Credit Note

- Downloads or previews the digital version.

- Download

- Triggers file download (PDF or system default).

Filters – Business Rules

Implement the following filters above the list view (dropdowns or chips):

- Status

- Values: All, Active, Applied

- Default: All

- Date Range

- Filter based on Created Date

- Options: Today, This Week, This Month, Custom Range

- Custom: Must include “From” and “To” validation

- Reason

- Multi-select dropdown

- Should list all system-defined reasons

- Consumer

- Search-enabled dropdown (or input) with autocomplete

- Remaining Amount

- Options:

- Fully Used (Remaining = 0)

- Partial Remaining (>0 and < Amount)

- Full Remaining (= Amount)

- Optional slider or range fields could be used

- Options:

- Linked Payment

- Search or select by receipt number

- Credit Amount Range

- Min - Max input for amount filters

- Supports numeric validations only

Credit Note Details View

Header

- Credit Note CN-10001

- Must be a unique system-generated ID.

- Prefix format (e.g., CN-) is required for identification.

- Display current status as a badge (e.g., Active, Applied, Expired).

Consumer Information

- Name & Account

- Show consumer name and unique account number.

- Must be consistent with payment records.

- Non-editable, pulled from linked payment.

Dates

- Created

- Timestamp of when the credit note was issued.

- System-generated, immutable.

- Expires

- One year from the creation date (default system logic).

- Must be configurable via system settings (optional).

Financial Details

- Original Credit Amount

- Value at the time of creation.

- Immutable once created.

- Remaining Balance

Original Credit Amount - Applied Amount- Cannot exceed the original amount.

- Applied Amount

- Total credit applied to bills/services.

- Auto-updated based on usage actions.

- Usage Percentage

(Applied Amount / Original Amount) × 100- Displayed with 1 decimal precision.

Credit Note Information

- Reason

- Selected during credit note creation.

- Should show as a badge (e.g., Overpayment, Billing Adjustment).

- Created By

- Name of the user or system admin who issued the credit note.

- Fetched from session/user context during creation.

- Linked Payment

- Clickable Receipt ID that opens the original payment details.

- Mandatory for traceability.

- Status

- Active: Remaining Balance > 0

- Applied: Remaining Balance = 0

- Print

- Opens a print preview of the credit note (PDF or system layout).

- Download PDF

- Triggers a download of the credit note as a PDF.

- Close

- Closes the modal; no action is saved.

8. Sample data

Consumer Search Sample Data

Field | Value |

|---|---|

Name | John Doe |

Account Number | WU-10001 |

Service Address | 123 Main Street, Cityville |

Current Balance | $245.75 |

Phone | (555) 123-4567 |

Available Bills (Sample)

Invoice Number | Billing Period | Amount | Due Date |

|---|---|---|---|

INV-2025-001234 | Mar 2025 | $145.50 | Apr 15, 2025 |

INV-2025-001567 | Apr 2025 | $152.25 | May 15, 2025 |

Service Charges (Sample)

Service Description | Amount | Service Date |

|---|---|---|

Reconnection Fee | $75.00 | Apr 18, 2025 |

Late Fee | $25.00 | Apr 10, 2025 |

Installment Plan (Sample)

Plan ID | Installment # | Amount | Due Date |

|---|---|---|---|

PP-2025-0034 | 1 | $67.50 | Apr 15, 2025 |

PP-2025-0034 | 2 | $67.50 | May 15, 2025 |

PP-2025-0034 | 3 | $67.50 | Jun 15, 2025 |

Cash Payment Transaction Sample

Field | Value |

|---|---|

Payment Type | Bill |

Payment Method | Cash |

Selected Invoice | INV-2025-001234 |

Billed Amount | $145.50 |

Amount Received | $150.00 |

Change Returned | $4.50 |

Notes | Customer paid in full |

Payment Summary Sample

Field | Value |

|---|---|

Payment ID | PAY-2025-004521 |

Transaction ID | TXN-2025-008934 |

Receipt Number | R-5001 |

Payment Status | Posted |

Payment Date | Apr 20, 2025 |

Channel | Walk-in |

Received By | Jane Smith |

Verification | Verified |

Processing Time | Immediate |

Credit Note Sample

Field | Value |

|---|---|

Credit Note # | CN-46129 |

Consumer | John Doe (WU-10001) |

Linked Receipt # | R-5001 |

Credit Amount | $4.50 |

Reason | Overpayment |

Created By | Jane Smith |

Status | Active |

Applied Amount | $0.00 |

Remaining Balance | $4.50 |

Expiry Date | Apr 20, 2026 |

Remarks | Customer overpaid due to billing adjustment |

Online Payment Status Mapping Sample

Stripe Status | Webhook Status | Settlement Status | Processing Time |

|---|---|---|---|

Succeeded | In Settlement | In Progress | 2.3 days |

Failed | Failed | N/A | N/A |

9. Acceptance Criteria

- The system must allow consumer search by name and account number with case-insensitive partial matching

- The system must display complete consumer account details including name, account number, service address, phone, email, and current balance

- The system must default to "Walk-in" channel and display all channels configured in settings

- The system must categorize payments into Bill, Service, and Installment types with distinct processing workflows

- The system must display current unpaid bills for bill payment type selection

- The system must display unpaid services for service payment type selection

- The system must display all unpaid installments for installment payment type selection

- The system must load payment methods from settings > payment mode configuration

- The system must calculate and display payment summary including amount, method, and outstanding/overpayment amounts

- The system must allow users to add optional additional notes with character limit validation

- The system must generate unique payment receipts upon successful payment submission

- The system must include all payment details in receipts: consumer info, payment summary, and processing information

- The system must provide receipt download and print functionality

- The system must offer "Record Another Payment" option after successful payment processing

- The system must provide "Return to Dashboard" option that redirects to the main dashboard

- The system must generate unique payment IDs using system number format configuration

- The system must mark user-recorded payments as "Posted" status automatically

- The system must map online payment gateway statuses according to defined webhook and settlement mappings

- The system must display payment amount analysis showing billed amount, amount paid, and difference (exact/over/under payment)

- The system must show cash payment details including amount received and change given for cash transactions

- The system must generate unique transaction IDs and receipt numbers using system number format

- The system must display "Immediate" processing time for user-recorded payments and calculate days for online payments

- The system must mark user-recorded payments as "Verified" and online payments as "Pending" with verification button

- The system must automatically generate credit notes for overpayments with unique sequential numbering

- The system must prevent credit note amounts from exceeding original payment amounts

- The system must require reason selection from predefined dropdown options (Overpayment, Duplicate Payment, Billing Error, etc.)

- The system must calculate remaining payment value as Original Payment Amount minus Credit Note Amount

- The system must set credit note expiry to one year from creation date by default

- The system must track credit note usage percentage and update status to "Applied" when remaining balance reaches zero

- The system must display header KPIs: Total Collected, Received Today, Collection Rate, and Average Collection Time

- The system must provide separate tabs for "All Payments" and "Credit Notes" with appropriate filtering

- The system must support text-based search across consumer name, receipt number, and consumer ID

- The system must provide filters for date range, payment method, payment status, and payment type

- The system must display payment table with Receipt #, Consumer, Amount, Method, Date, Type, and Status columns

- The system must make receipt numbers clickable to open detailed payment view

- The system must support search functionality for credit notes by credit note number, consumer name, account number, and linked receipt

- The system must display credit note table with Credit Note #, Consumer, Amount, Remaining, Reason, Status, Created Date, and Linked Payment columns

- The system must provide filters for status, date range, reason, consumer, remaining amount, and linked payment

- The system must offer three-dot menu actions: View Details, Print Credit Note, View Credit Note, and Download

- The system must enforce payment classification rules for Bill, Service, and Installment types

- The system must validate that credit amounts cannot be negative or exceed original payment amounts

- The system must automatically update credit note status based on remaining balance calculations

- The system must maintain audit trails for all credit note creation and modification activities

- The system must support configurable credit note expiry periods through system settings

- The system must enforce mandatory field validation for payment recording including amount, method, type, consumer, and date

10. Process Changes

Process Area | From | To | Impact Analysis |

|---|---|---|---|

Payment Plan Creation | Manual documentation in separate systems with limited tracking | Integrated digital payment plan setup with automated compliance monitoring | Efficiency Gain: 60% - Reduced setup time from 30 minutes to 12 minutes per plan. Basis: Current manual process involves multiple system entries and paper documentation |

Payment Recording | Multiple systems requiring manual entry and reconciliation | Unified payment processing with automatic posting and confirmation | Accuracy Improvement: 45% - Elimination of dual-entry errors and automatic validation. Basis: Current error rate of 3.2% reduced to 1.8% through automation |

Customer Payment Inquiry | Staff searching through multiple screens and systems | Single comprehensive payment view with complete transaction history | Service Time Reduction: 40% - Customer inquiry resolution time reduced from 8 minutes to 4.8 minutes. Basis: Time study of current multi-system lookup process |

Payment Plan Monitoring | Manual review of spreadsheets and reports | Automated compliance tracking with proactive alerts | Compliance Improvement: 75% - Early intervention on payment plan violations increased from 35% to 85%. Basis: Current manual review identifies issues after 2-3 missed payments |

Payment Reporting | Manual compilation of data from multiple sources | Automated dashboard with real-time analytics | Reporting Efficiency: 80% - Monthly reporting preparation time reduced from 16 hours to 3.2 hours. Basis: Current manual data compilation and validation process |

Payment Reconciliation | Daily manual matching of transactions across systems | Automated reconciliation with exception-based review | Processing Speed: 70% - Daily reconciliation time reduced from 4 hours to 1.2 hours. Basis: Current manual matching of bank statements to system records |

Collection Activities | Separate systems for payment plans and collection actions | Integrated workflow connecting payment arrangements to field operations | Coordination Improvement: 50% - Reduced disconnection errors from 12% to 6% through integrated payment status. Basis: Current lack of real-time payment status visibility |

11. Impact from Solving This Problem

Metric Category | Improvement Description |

|---|---|

✅ Collection Rate | Increase from 89.2% to 94.5% through improved payment plan management and automated follow-up processes |

✅ Average Collection Time | Reduce from 4.3 days to 3.1 days through streamlined payment processing and real-time posting |

✅ Customer Service Efficiency | Improve payment inquiry resolution time by 40% through unified payment history access |

✅ Payment Plan Compliance | Increase successful completion rate from 68% to 85% through automated monitoring and alerts |

✅ Processing Accuracy | Reduce payment posting errors from 3.2% to 1.8% through automated validation and single-entry processing |

✅ Staff Productivity | Increase payment processing capacity by 35% through streamlined workflows and automation |

✅ Revenue Recovery | Improve bad debt recovery by 25% through enhanced payment arrangement capabilities |

✅ Customer Satisfaction | Increase payment-related satisfaction scores from 7.2 to 8.6 through improved service capabilities |

✅ Operational Cost | Reduce payment processing costs by 30% through automation and elimination of manual processes |

✅ Compliance Reporting | Achieve 100% accuracy in regulatory payment reporting through automated data compilation |

12. User Behavior Tracking

Billing Manager Tracking Plan

Metric | Event | Properties | Insights Goal |

|---|---|---|---|

Dashboard Usage |

|

,

,

,

| Understanding which payment metrics are most valuable for decision-making |

Report Generation |

|

,

,

,

| Identifying most valuable reporting capabilities and performance optimization needs |

Alert Configuration |

|

,

,

| Understanding proactive monitoring preferences and effectiveness |

Drill-down Analysis |

|

,

,

,

| Measuring analytical behavior patterns and data exploration needs |

Questions Answered: How do billing managers prioritize payment performance monitoring? Which metrics drive operational decisions? What reporting frequency is most valuable?

Recovery Executive Tracking Plan

Metric | Event | Properties | Insights Goal |

|---|---|---|---|

Payment Plan Creation |

|

,

,

,

| Understanding successful payment arrangement patterns and negotiation effectiveness |

Compliance Monitoring |

|

,

,

,

| Measuring proactive collection management and intervention effectiveness |

Collection Actions |

|

,

,

,

| Tracking collection strategy effectiveness and customer engagement patterns |

Payment Recording |

|

,

,

,

| Analyzing payment plan performance and preferred payment methods |

Questions Answered: What payment plan terms result in highest compliance? How quickly do executives respond to payment violations? Which collection strategies are most effective?

Customer Executive Tracking Plan

Metric | Event | Properties | Insights Goal |

|---|---|---|---|

Payment Processing |

|

,

,

,

,

| Measuring transaction efficiency and customer service quality |

Customer Inquiry Resolution |

|

,

,

,

| Understanding common payment issues and service effectiveness |

Payment History Access |

|

,

,

,

| Analyzing information usage patterns and customer service needs |

Payment Plan Setup |

|

,

,

,

| Tracking in-person payment arrangement effectiveness and customer preferences |

Questions Answered: What payment issues consume most customer service time? How effective are face-to-face payment arrangements? Which payment methods do customers prefer for different transaction types?

13. Wire frame

https://preview--utility-compass-flow-41.lovable.app/payments/new