Outstanding Management System

1. Problem Statement

User Roles Identified:

- Recovery Executive: Collections specialist responsible for managing delinquent accounts

- CSO Manager: Customer service operations manager overseeing collection strategies

- Billing Manager: Oversees billing operations and revenue recovery

Pain Points by User Role:

Recovery Executive:

- Cannot easily identify which consumers have the highest outstanding amounts

- Lacks visibility into how long consumers have been delinquent

- Unable to systematically send disconnection notices

- No streamlined process for setting up payment agreements

- Difficult to prioritize collection efforts effectively

CSO Manager:

- Cannot assess overall collection performance and risk exposure

- Lacks data-driven insights for collection strategy decisions

- Unable to monitor team performance on collection activities

- No visibility into consumer communication history

- Difficult to balance collection efforts with customer retention

Billing Manager:

- Cannot track total revenue at risk from outstanding accounts

- Lacks ability to analyze collection trends and patterns

- Unable to generate comprehensive reports for management

- No systematic approach to account statement distribution

- Difficult to coordinate collection activities across teams

Core Problem:

The utility lacks a centralized system to identify, prioritize, and take action on consumers with outstanding balances, resulting in increased bad debt, inefficient collection processes, and poor customer communication.

2. Who Are the Users Facing the Problem?

Recovery Executive

- Primary user responsible for day-to-day collection activities

- Manages individual consumer accounts and payment arrangements

- Initiates disconnection processes and customer communications

CSO Manager

- Oversees collection operations and strategy

- Monitors team performance and collection metrics

- Makes decisions on collection policies and procedures

Billing Manager

- Responsible for revenue protection and billing accuracy

- Analyzes financial impact of outstanding accounts

- Coordinates with other departments on collection activities

Access Requirements:

- All three roles should have access to the feature with role-specific permissions

- Recovery Executive: Full access to individual account actions

- CSO Manager: Dashboard access and team performance metrics

- Billing Manager: Financial reporting and analytical capabilities

3. Jobs To Be Done

For Recovery Executive: When I need to prioritize my daily collection activities, But I can't easily see which consumers have the highest outstanding amounts or longest delinquency periods, Help me quickly identify and rank consumers by risk and outstanding amount, So that I can focus my efforts on the most critical accounts and maximize collection success.

For Recovery Executive: When I need to take action on delinquent accounts, But I have to use multiple systems to send notices, set up agreements, or communicate with consumers, Help me access all collection tools from a single interface, So that I can efficiently manage the entire collection process and improve my productivity.

For CSO Manager: When I need to develop collection strategies and monitor team performance, But I lack comprehensive data on collection trends and team activities, Help me access real-time dashboards and analytics on collection performance, So that I can make data-driven decisions and optimize our collection operations.

For Billing Manager: When I need to assess the financial impact of outstanding accounts, But I can't easily quantify total revenue at risk or analyze collection patterns, Help me generate comprehensive reports and analytics on outstanding balances, So that I can protect revenue and provide accurate financial reporting to management.

4. Solution

Comprehensive Outstanding Consumer Management Platform

The solution provides a centralized dashboard and workflow system that enables utility staff to identify, prioritize, and take action on consumers with outstanding balances through intelligent risk assessment and streamlined collection tools.

Key Capability Areas:

1. Risk Assessment & Prioritization

- Automated risk scoring based on outstanding amount, delinquency period, and payment history

- Configurable priority rankings with visual indicators

- Advanced filtering and sorting capabilities

2. Consumer Identification & Analytics

- Real-time dashboard showing total outstanding consumers and amounts

- Trending analysis of collection performance

- Geographic and demographic segmentation of outstanding accounts

3. Communication Management

- Automated disconnection notice generation and delivery

- Template-based account statement creation

- Multi-channel communication tracking (email, SMS, mail, phone)

4. Payment Agreement Setup

- Guided workflow for creating payment arrangements

- Automated approval routing based on amount and terms

- Agreement compliance monitoring and alerts

5. Action Tracking & Documentation

- Complete audit trail of all collection activities

- Task management and follow-up reminders

- Integration with customer service records

6. Reporting & Performance Analytics

- Executive dashboards for collection performance metrics

- Individual and team performance tracking

- Financial impact analysis and forecasting

7. Integration & Workflow Automation

- Seamless integration with billing and customer service systems

- Automated workflow triggers based on account status

- Role-based access controls and approval processes

5. Major Steps Involved

Recovery Executive Workflow:

Step 1: Access Outstanding Consumer Dashboard

- Login to SMART360 and navigate to Collections module

- View prioritized list of outstanding consumers with risk scores

- Use filters to focus on specific criteria (amount, days past due, location)

Step 2: Review Consumer Details

- Click on consumer record to open detailed view

- Review account history, payment patterns, and previous collection activities

- Assess risk factors and communication preferences

Step 3: Take Collection Action

- Select appropriate action from available options menu

- For disconnection notices: Choose template, customize message, schedule delivery

- For payment agreements: Launch guided setup wizard

- For account statements: Generate and send via preferred channel

Step 4: Document Activities

- Record collection attempt details and outcome

- Set follow-up reminders and next action dates

- Update account status and priority level

Step 5: Monitor Agreement Compliance

- Review active payment agreements for compliance

- Generate compliance reports and alerts

- Take action on broken agreements

CSO Manager Workflow:

Step 1: Access Collection Performance Dashboard

Step 2: Analyze Team Performance

- View individual recovery executive statistics

- Compare performance across different territories or consumer segments

- Identify training needs and best practices

Step 3: Strategic Decision Making

- Review collection strategy effectiveness

- Adjust policies and procedures based on performance data

- Coordinate with other departments on collection initiatives

Billing Manager Workflow:

Step 1: Financial Impact Assessment

Access revenue protection dashboardReview total outstanding amounts and aging analysisGenerate financial reports for management

Step 2: Collection Trend Analysis

Analyze historical collection performanceIdentify seasonal patterns and risk factorsForecast bad debt and collection rates

Step 3: Process Optimization

Review collection workflow efficiencyImplement process improvements based on analyticsCoordinate billing and collection activities

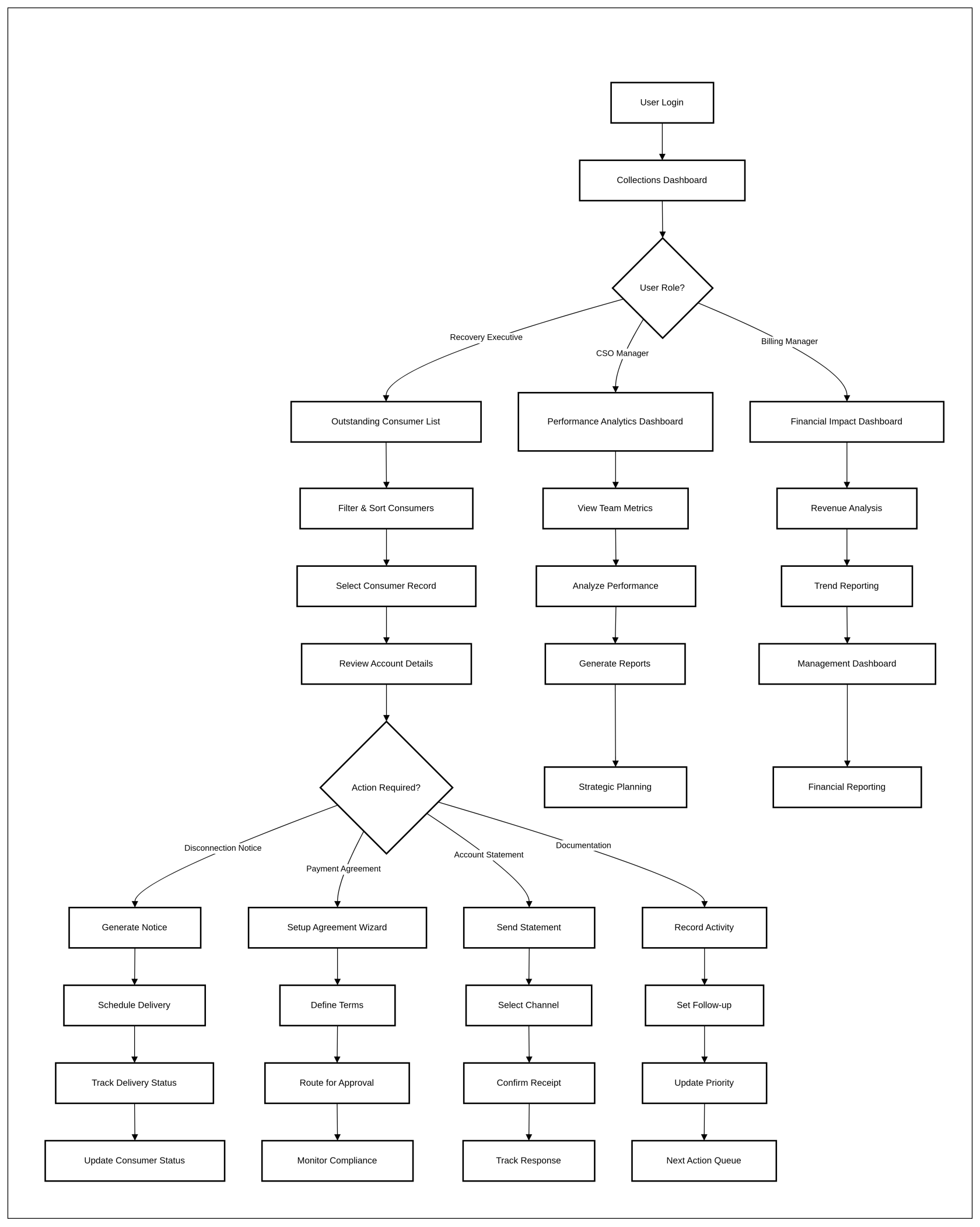

6. Flow Diagram

flowchart TD

A[User Login] --> B[Collections Dashboard]

B --> C{User Role?}

C -->|Recovery Executive| D[Outstanding Consumer List]

C -->|CSO Manager| E[Performance Analytics Dashboard]

C -->|Billing Manager| F[Financial Impact Dashboard]

D --> G[Filter & Sort Consumers]

G --> H[Select Consumer Record]

H --> I[Review Account Details]

I --> J{Action Required?}

J -->|Disconnection Notice| K[Generate Notice]

J -->|Payment Agreement| L[Setup Agreement Wizard]

J -->|Account Statement| M[Send Statement]

J -->|Documentation| N[Record Activity]

K --> O[Schedule Delivery]

L --> P[Define Terms]

M --> Q[Select Channel]

N --> R[Set Follow-up]

O --> S[Track Delivery Status]

P --> T[Route for Approval]

Q --> U[Confirm Receipt]

R --> V[Update Priority]

E --> W[View Team Metrics]

W --> X[Analyze Performance]

X --> Y[Generate Reports]

F --> Z[Revenue Analysis]

Z --> AA[Trend Reporting]

AA --> BB[Management Dashboard]

S --> CC[Update Consumer Status]

T --> DD[Monitor Compliance]

U --> EE[Track Response]

V --> FF[Next Action Queue]

Y --> GG[Strategic Planning]

BB --> HH[Financial Reporting]7. Business Rules

GeneralDetail Rulesview

- Account number - diplay the account number of the consumer

- Consumer name - display consumer name

- Category

- Outstanding

balanceamountcalculation-includesdisplayprincipal,theinterest,outstandingandamountapplicablethatfeeshas pass due date Risk scoring updates automatically when account status changesAll collection activities must be documented within 24 hoursSystem maintains complete audit trail of all actions and communications

Balance Summary card

Role-Specific Rules

Recovery Executive:

Can only access consumers assigned to their territoryCannot approve payment agreements exceeding $500 without supervisor approvalMust follow regulatory compliance guidelines for collection communicationsCannot modify risk scoring parameters

CSO Manager:

Has access to all consumer records within their jurisdictionCan approve payment agreements up to $2,000Can modify collection strategies and templatesHas read-only access to financial reporting

Billing Manager:

Full access to financial analytics and reportingCannot initiate collection actions directlyCan adjust billing-related componentsDays of outstandingbalances- display the number of days passed after the last paymentHasLastauthoritypayment - display the last payment date- Risk -

- if days passed are less than 30 then low

- if days passed are between 31 to

write60offthenuncollectablemedium - if

accountsdaysperpassedpolicyare between 61 to 90 then high - if days passed are 90+ then critical

Process - Follow

Rulesup -DisconnectionRequirednotices-requirewhen15-daynoadvanceactions are taken- Reminder send - when a reminder is send

- Final notice

per-regulationswhen final notice is send - Aggrement created - when an agreement is created

- Process payment - redirect to record payment add form with pre selected consumer

- create agreement -

- Display outstanding balance

- Current billed amount

- checkbox - Include current billed amount in payment agreement

- total agreement amount

- Down payment - cannot be more than total agreement amount

- number of installments - select number of months for the remaining balance installments

- Notes - textbox - optional

- Payment

agreementssummary- Total

cannotamountexceed 12 months without special approvaldue High-riskDownaccounts (>$1,000 outstanding) require supervisor reviewpaymentAutomatedRemainingescalationbalanceoccurs- total amount after90subtractingdaysdownpastpaymentduefrom total agreement amount- Monthly payment - dividing the remaining balance by number of installments

Data - Total

- Create

ValidationagreementRules- - create a agreement and display a success message

- print agreement - print the agreement form

- Print statement - print the account statement

- Send Reminder - Select reminder type which should be configured in the communication module. Riminder can be print and a success message should be shown

- Send Notice - an disconnection notice should be send and a disconnection request should be generated in the Disconnection tab with the reason non - payments of bills.

- Send statement - An account statement should be send to consumer on the mail.

- Payment agreement

amounts must be positive valuesInformation - Agreement

startiddates-cannotfrom num format - created date

- created by

- total amount

- Down payment

- monthly payment

- Start date

- End date

- Notes - if added when createing aan aggreement

- view agreement document - view the agreement created

- cancle agreement - can only be canclled if no installments are paid. if any one is paid then button is disable

- Payment aggreement installmation - display all the installments with amount, status (Pending , paid, overdue), due date, paid date (if paid), Days overdue (days after duedate passed)

- Total paid - Display the total paid amount

- Total due - display the total due

- remaining - display the total remaining amount

- User can add notes - User name, date, and note

- Total outstanding - display the total outstanding, excluding the billed amount

- Accounts - display the number of accounts whoes outstanding is not 0

- Average days outstanding - total days of outstanding / total number of accounts outstanding - display round figure days

- Collection rate - (Total Amount Collected in the

pastcurrent month / Total Amount Billed in the current month) × 100 Notice delivery mustcan beconfirmedsearchwithinby5thebusinessAccount no and name- days

- follow up

- Risk

- due

scores recalculate daily at midnightdate - outstanding

- should be applicable for all coloums in list view

- Account - account number, name, premise, sub area

- billed amount - current month billed amount, move it in outstanding when due date is passed

- Due date - current bill due date'

- outstanding - outstanding amount of the current bill

- Days - days passed after llast payment

- Last payment - amount, date

- Follow up

- Risk

- Action - View details, create aggresment, send notice

- Download the all the data in the format of the listview coloums

- Consumer ID: CON-2024-001

- Name: John Smith

- Outstanding Amount: $1,250.75

- Days Past Due: 87

- Risk Score: 85 (High)

- Last Payment: $125.00 (2024-01-15)

- Previous Agreements: 1 (Completed)

- Communication Preference: Email

- Territory: Zone A

- Consumer ID: CON-2024-002

- Name: Maria Garcia

- Outstanding Amount: $2,345.20

- Days Past Due: 134

- Risk Score: 95 (Critical)

- Last Payment: $50.00 (2023-11-30)

- Previous Agreements: 2 (1 Broken)

- Communication Preference: Phone

- Territory: Zone B

- Consumer ID: CON-2024-003

- Name: Robert Johnson

- Outstanding Amount: $567.45

- Days Past Due: 45

- Risk Score: 65 (Medium)

- Last Payment: $200.00 (2024-02-20)

- Previous Agreements: 0

- Communication Preference: Mail

- Territory: Zone A

- Agreement ID: AGR-2024-156

- Consumer: John Smith (CON-2024-001)

- Total Amount: $1,250.75

- Monthly Payment: $125.08

- Term: 10 months

- Start Date: 2024-04-01

- Created By: Recovery Executive - Jane Doe

- Approval Status: Approved

- Compliance Status: Current (3 of 10 payments made)

- Activity ID: ACT-2024-2341

- Consumer: Maria Garcia (CON-2024-002)

- Action Type: Disconnection Notice Sent

- Date: 2024-03-15

- Channel: Email + Mail

- Template Used: Final Notice - 15 Day

- Created By: Recovery Executive - Mike Wilson

- Status: Delivered

- Follow-up Date: 2024-03-30

- The system must display a prioritized list of all

consumersconsumer accounts with outstanding balancesrankedalongbywith associated riskscorelevels. - The system must calculate and display risk

scoreslevels based onconfigurable parameters including amount,dayspastsincedue, andlast paymenthistoryusing predefined ranges (Low, Medium, High, Critical). - The system must allow filtering

consumersof consumer accounts byamount ranges,dayspastoutstanding,due,riskterritory,level, follow-up status, due date, andriskoutstandinglevelamount. - The system must enable recovery executives to

generatesend reminders andsenddisconnection notices usingcustomizablepredefined templates from the communication module. - The system must provide a guided workflow

fortosetting upcreate payment agreements withautomatedoptionsapprovalforroutingdown payment, installment selection, and auto-calculated monthly amounts. - The system must track and

confirm delivery oflog allcommunicationsfollow-upsentactionstoincludingconsumers Thereminders,systemnotices,mustandmaintainagreementa complete audit trail of all collection activitiescreation with timestamps and useridentificationdetails.- The system must prevent agreement cancellation if any installment has already been paid.

- The system must automatically

escalateupdateaccountsfollow-up status based onconfigurablethebusinesslatestrulesaction performed. - The system must allow exporting of all consumer outstanding data in the format of the list view.

- The system must provide

real-timeadashboardsdashboardshowingdisplaying KPIs including total outstanding, number of accounts, average days outstanding, and collectionperformance metrics by individual and teamrate. - The system must generate and allow sending of account statements

that can be sentviamultipleemailchannelsto(email, SMS, mail)consumers. - The system must

monitorallow printing of agreement documents and account statements directly from the interface. - The system must compute payment agreement

compliancesummaries including total due, down payment, remaining balance, andgeneratemonthlyalertsinstallments. - The system must track the compliance of each payment agreement and update installment status as Paid, Pending, or Overdue.

- The system must restrict actions (e.g., cancel agreement, send notice) based on role-based permissions and agreement/payment status.

- The system must support search functionality by account number and consumer name.

- The system must allow users to add notes tied to their identity and timestamps for

missedinternalpaymentstracking. - The system must provide a history log of all actions taken on the consumer account in relation to outstanding follow-ups and agreements.

- The system must allow sorting on all list view columns to assist in prioritization and navigation.

- The system must integrate with

existingbillingsystemand payment modules to ensure accurateoutstandingdisplaybalanceofcalculations Thebilledsystem must provide role-based access controls restricting actions based on user permissionsThe system must support bulk actions for processing multiple consumer accounts simultaneouslyThe system must generate automated reports on collection performance, revenue at risk,amounts andagingoutstandinganalysisThe system must allow managers to override risk scores and priorities when justifiedThe system must track the success rate of different collection strategies and communication methodsThe system must provide mobile access for field collection activitiesThe system must ensure all collection communications comply with regulatory requirementsThe system must enable seamless handoff of accounts between recovery executivesbalances.- Which collection strategies yield the highest success rates

- How risk scoring accuracy predicts collection outcomes

- What consumer characteristics lead to successful payment agreements

- How workload distribution affects individual performance

- Which team performance metrics correlate with collection success

- How management attention affects team performance

- What strategic changes improve overall collection outcomes

- How often collection policies need adjustment

- Which financial metrics best predict collection challenges

- How aging patterns change with different collection strategies

- What economic factors influence collection performance

- How collection activities impact overall revenue protection

Actions tab

Installment Tab

Notes tab

History Tab

Display all the history of the outstanding actions taken on the consumer

Landing page

KPI cards

Search bar

Filter

Sort

listview

Export data

8. Sample Data

Outstanding Consumer Records

Consumer Record 1:

Consumer Record 2:

Consumer Record 3:

Payment Agreement Sample

Agreement Details:

Collection Activity Log

Activity Record:

9. Acceptance Criteria

10. Process Changes

Process Area | From | To | Impact |

|---|---|---|---|

Consumer Prioritization | Manual review of aging reports to identify high-risk accounts | Automated risk scoring with prioritized dashboard view | 60% reduction in time spent identifying priority accounts |

Disconnection Notice Process | Manual letter generation using word processing software | Template-based automated notice generation with multi-channel delivery | 75% faster notice processing and improved delivery tracking |

Payment Agreement Setup | Paper-based forms with manual approval routing | Digital workflow with guided setup and automated approval | 50% reduction in agreement setup time and improved compliance tracking |

Collection Activity Documentation | Spreadsheet tracking with manual data entry | Integrated activity logging with automatic timestamps | 80% improvement in documentation accuracy and completeness |

Performance Monitoring | Monthly manual reports compiled from multiple sources | Real-time dashboards with automated metrics calculation | 90% faster access to performance data and improved decision-making |

Account Statement Distribution | Batch printing and manual mailing process | Digital generation with multi-channel delivery options | 40% cost reduction and faster delivery times |

Collection Strategy Planning | Quarterly reviews based on limited historical data | Continuous optimization using real-time analytics and trend analysis | 30% improvement in collection success rates |

Team Coordination | Email updates and weekly meetings for status coordination | Centralized system with real-time status updates and automated alerts | 50% reduction in coordination time and improved communication |

Impact percentages are based on industry benchmarks for similar utility collection system implementations and typical process automation benefits.

11. Impact from Solving This Problem

Impact Category | Metric | How It Improves |

|---|---|---|

Financial Performance | Bad Debt Reduction | Proactive identification and management of high-risk accounts reduces write-offs by 25-35% |

Operational Efficiency | Collection Cycle Time | Automated workflows and prioritization reduce average collection time from 120 to 75 days |

Staff Productivity | Cases Handled Per Day | Streamlined interface and automated tools increase recovery executive productivity by 40% |

Customer Experience | Payment Plan Compliance | Structured agreement process improves payment plan success rate from 65% to 85% |

Revenue Protection | Days Sales Outstanding | Faster identification and action on delinquent accounts reduces DSO by 15-20 days |

Regulatory Compliance | Documentation Accuracy | Automated audit trails ensure 100% compliance with collection activity documentation requirements |

Management Visibility | Decision Response Time | Real-time dashboards enable management decisions within hours instead of weeks |

Communication Effectiveness | Notice Response Rate | Multi-channel delivery and tracking improves customer response to collection notices by 50% |

Process Standardization | Workflow Consistency | Standardized processes across all recovery executives improve overall collection success rate by 20% |

Risk Management | Early Intervention Success | Automated risk scoring enables intervention 30 days earlier, improving resolution rates by 45% |

12. User Behavior Tracking

Recovery Executive Tracking Plan

Event Name | Trigger | Properties | Business Question |

|---|---|---|---|

| User accesses outstanding consumer dashboard | user_id, filter_criteria, sort_method, list_size | How do recovery executives prioritize their workload? |

| User clicks on consumer record | user_id, consumer_id, risk_score, outstanding_amount | Which types of accounts get the most attention? |

| User starts any collection action | user_id, consumer_id, action_type, risk_score | What collection strategies are most commonly used? |

| User creates disconnection notice | user_id, consumer_id, template_used, delivery_method | How effective are different notice templates? |

| User sets up payment arrangement | user_id, consumer_id, agreement_amount, term_length | What agreement terms lead to highest success rates? |

| User records collection activity | user_id, consumer_id, activity_type, outcome | How well are collection activities being documented? |

CSO Manager Tracking Plan

Event Name | Trigger | Properties | Business Question |

|---|---|---|---|

| Manager views performance dashboard | user_id, dashboard_type, time_period | What metrics do managers focus on most? |

| Manager accesses team analytics | user_id, team_member, metric_type, time_period | How do managers monitor team performance? |

| Manager creates custom report | user_id, report_type, parameters, frequency | What information is most valuable for strategic decisions? |

| Manager changes collection policies | user_id, policy_type, old_value, new_value | How do collection strategies evolve over time? |

Billing Manager Tracking Plan

Event Name | Trigger | Properties | Business Question |

|---|---|---|---|

| User accesses revenue analytics | user_id, dashboard_section, time_period | What financial metrics are most critical for decision-making? |

| User reviews account aging data | user_id, aging_buckets, total_amount | How does account aging correlate with collection success? |

| User analyzes collection trends | user_id, trend_type, time_period, comparison_period | What trends indicate collection strategy effectiveness? |

| User generates executive report | user_id, report_type, recipients, frequency | What information does executive leadership require? |

Key Insights Expected:

From Recovery Executive Events:

From CSO Manager Events:

From Billing Manager Events:

14. Wireframe

https://preview--utility-compass-flow-41.lovable.app/payments/new