Consumer management (CIS01US02)

1. Problem Statement

For Customer Service Representative (CSO Manager/Customer Executive/Call Center Representative):

- Inability to efficiently manage and view comprehensive consumer account information in a single interface

- Limited visibility into detailed consumer profiles, including billing, payment history, service connections, and interaction records

- Lack of quick action capabilities from the consumer detail view to perform common tasks like creating service orders or registering complaints

- Difficulty in accessing complete consumer summary with all relevant metrics and insights in one location

- Challenges in maintaining comprehensive communication history and notes for each consumer account

For Recovery Executive:

- Cannot easily identify high-risk accounts requiring immediate attention based on payment patterns and balance information

- Limited visibility into payment compliance metrics and collection history for informed decision-making

- Difficulty in accessing complete financial overview including outstanding balances and payment method information

Core Problem:

The current consumer management system lacks a comprehensive, unified interface that provides complete visibility into consumer accounts, their service history, financial status, and enables quick actions for efficient customer service delivery. This results in fragmented information access, reduced service efficiency, and inability to provide personalized customer experiences.

2. Who Are the Users Facing the Problem?

Customer Service Representative (CSO Manager/Customer Executive/Call Center Representative):

- Manages daily customer interactions across multiple channels

- Handles service requests, billing inquiries, and account modifications

- Requires complete customer context for effective problem resolution

- Needs quick access to service history and communication records

Recovery Executive:

- Manages past-due accounts and collection activities

- Negotiates payment arrangements with delinquent customers

- Requires detailed payment history and compliance metrics

- Needs visibility into account status and risk indicators

3. Jobs To Be Done

For Customer Service Representative:

- When I need to access complete consumer account information during customer interactions, But I have to navigate through multiple screens and systems to gather relevant details, Help me view a unified consumer profile with all essential information in one interface, So that I can provide efficient and personalized customer service without delays.

- When I need to take immediate actions on consumer accounts like creating service orders or updating information, But I lack quick action capabilities from the consumer detail view, Help me access common action buttons and workflows directly from the consumer profile, So that I can resolve customer issues faster and improve service efficiency.

- When I need to understand the complete history of interactions and services for a consumer, But I cannot see comprehensive timeline and activity logs in one place, Help me access detailed activity timeline with filters and search capabilities, So that I can provide informed responses and maintain service continuity.

For Recovery Executive:

- When I need to identify consumers requiring immediate collection attention, But I lack clear visibility into payment compliance and balance status, Help me access consumer accounts with highlighted risk indicators and financial summaries, So that I can prioritize collection activities and improve recovery rates.

- When I need to understand payment patterns and compliance history for collection decisions, But I cannot easily access comprehensive payment analytics and trends, Help me view detailed payment history with compliance metrics and pattern analysis, So that I can make informed collection strategies and negotiation approaches.

4. Solution

The Consumer Management system provides a comprehensive solution for managing utility consumer accounts with complete visibility and quick action capabilities:

Key Capability Areas:

- Consumer Dashboard & Overview

- Total account metrics with real-time counts (Total, Active, Inactive, Temporarily Disconnected)

- Advanced search functionality across multiple consumer attributes

- Filter and sorting capabilities for efficient account management

- Bulk selection and actions for multiple accounts

- Consumer Profile Management

- Unified consumer profile with complete account information

- Contact information management with service and billing addresses

- Account categorization and sub-category classification

- VIP status indicators and relationship insights

- Financial Management Interface

- Current balance display with payment status indicators

- Comprehensive payment history with multiple payment methods

- Next due date tracking with countdown timers

- Payment compliance metrics and trend analysis

- Service Connection Management

- Utility connection details with meter information

- Real-time meter readings and consumption tracking

- Service status monitoring (Active, Inactive, Pending)

- Connection history and assignment tracking

- Service Order & Request Management

- Service order creation and tracking capabilities

- Request management with status monitoring

- Automated workflow integration for field operations

- Service history with completion status

- Communication & Document Management

- Complete communication history across all channels

- Document repository with verification status tracking

- Automated communication triggers and notifications

- Customer notes and interaction logging

- Activity Timeline & Tracking

- Comprehensive activity timeline with category filters

- Real-time activity updates and notifications

- Historical activity search and filtering

- Cross-reference capabilities between activities

- Quick Actions & Workflows

- Context-sensitive action buttons for common tasks

- Workflow automation for routine processes

- Bulk operations for multiple account management

- Integration with external systems and processes

5. Major Steps Involved

For Customer Service Representative managing consumer accounts:

- Access Consumer Dashboard

- Navigate to Consumer Management module in SMART360

- View dashboard showing Total Accounts (7), Active Accounts (4), Inactive Accounts (1), Temporarily Disconnected (1)

- Review percentage distributions (57% Active, 14% Inactive, 14% Temporarily Disconnected)

- Use search bar to find specific consumers by name, account number, phone, email, or address

- Filter and Search Consumers

- Apply filters using Filter button to narrow down account lists

- Use Sort functionality to organize accounts by different criteria

- Adjust Display settings to customize information visibility

- Select consumers using checkboxes for bulk operations

- Access Consumer Profile

- Click on consumer name (e.g., "John Doe") from the consumer list

- View consumer profile header with account number (WU-10001), status (Active), and VIP indicator

- Review current balance ($75.30) and last billing date (Apr 15, 2025)

- Check alert notifications (Payment due in 3 days, Scheduled maintenance on May 24)

- Navigate Consumer Profile Tabs

- Use Overview tab to see relationship insights (85/100 health score) and consumption charts

- Access Financial tab for detailed payment history and billing information

- Review Connections tab for meter details and utility service information

- Check Service tab for service orders and maintenance history

- Review Financial Information

- View Account Balance section showing current balance ($75.30) and next bill estimate ($110-130)

- Check Payment History table with dates, payment numbers, amounts, methods, and status

- Access Billing Overview showing rate plan, billing cycle, payment method, and average usage

- Review payment compliance percentage (92%) and outstanding amount details

- Manage Service Connections

- Review Water Service connection status (Active)

- Check Meter Details including meter number (M-5678), device number (D-9012), and model (Aquaflow X200)

- View Monthly Meter Readings table with historical consumption data

- Monitor reading status (Verified) and assignment dates

- Handle Service Requests and Orders

- Review Service Orders table showing order numbers, dates, types, descriptions, and status

- Create new service orders using "Create Service Order" button

- Track service request status (In Progress, Scheduled, Completed)

- Access detailed service history for reference

- Manage Communication and Documentation

- Use Communication History to review all customer interactions

- Access Document Repository for service agreements, billing authorizations, and reports

- Add new consumer notes using the notes interface

- Send messages to customers using "Send Message" button

- Monitor Activity Timeline

- Access Activity Timeline with filter options (All, Payments, Billing, Service, Communication, Account)

- Search specific activities using the search bar

- Review detailed activity logs with timestamps and system actions

- Track payment processing, email communications, and account updates

- Perform Quick Actions

- Use "Update Profile" button to modify consumer information

- Access "Quick Actions" dropdown for common operations

- Register new complaints using dedicated complaint management

- Create transfer, disconnection, or reconnection requests as needed

For Recovery Executive managing collection activities:

- Identify Collection Accounts

- Review consumer list focusing on balance amounts and payment status

- Identify accounts with "Collection" payment status (e.g., David Miller - $389.30)

- Filter accounts by "Past Due" status for prioritized attention

- Sort accounts by outstanding balance for risk assessment

- Analyze Payment Compliance

- Access consumer profiles with payment compliance metrics (e.g., 92% compliance)

- Review payment history patterns for collection strategy development

- Check "Days remaining" indicators for urgent accounts

- Assess relationship health scores for collection approach

- Manage Collection Activities

- Document collection attempts in consumer notes

- Track payment arrangements and compliance monitoring

- Coordinate disconnection/reconnection activities with field operations

- Update account status based on collection outcomes

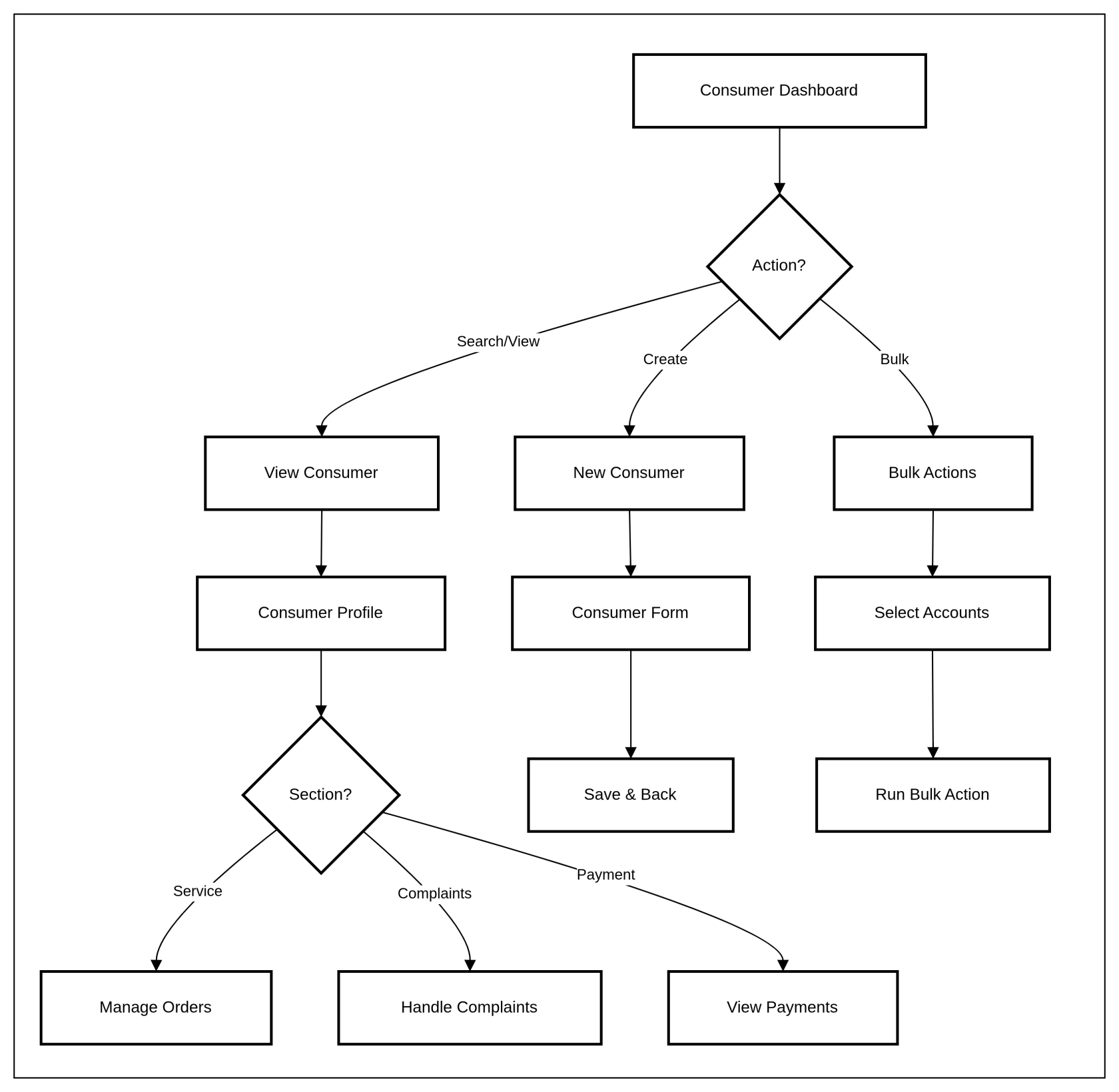

6. Flow Diagram

7. Business Rules

General Consumer Management Rules:

- Total Accounts count must reflect sum of all consumer accounts in the system (displayed as 7 in dashboard)

- Active Accounts percentage must be calculated as (Active Accounts / Total Accounts) × 100 (57% shown)

- Inactive Accounts percentage must be calculated as (Inactive Accounts / Total Accounts) × 100 (14% shown)

- Temporarily Disconnected percentage must be calculated as (Temporarily Disconnected / Total Accounts) × 100 (14% shown)

- Total balance must aggregate all individual consumer balances ($2044.50 shown)

- Search functionality must support name, account number, phone, email, and address fields

- Consumer status indicators must display appropriate colors (Active: Green, Inactive: Red, Pending: Yellow, Disconnected: Orange)

Consumer Profile Rules:

- Account Number format must follow utility prefix pattern (WU-10001, WU-10002, etc.)

- Consumer Number must match Account Number for consistency (WU-10001)

- VIP status indicators must be based on predefined criteria and display gold crown icon

- Current Balance must reflect most recent billing calculation ($75.30)

- Last Billed date must show actual billing date (Apr 15, 2025)

- Next bill estimate range must be calculated based on usage patterns ($110-130)

- Relationship Health score must be calculated from multiple factors (85/100)

Relationship Health Score Formula

Relationship Health Score =

(0.4 × Payment Compliance%)

- (0.25 × Service Quality Score)

- (0.15 × Communication Responsiveness)

- (0.1 × Account Longevity Factor)

- (0.05 × Digital Engagement)

- (0.05 × Complaint Resolution Rate)

− Penalty Factors

Detailed Breakdown

1. Payment Compliance (40%)

- Formula:

(On-time Payments / Total Payments) × 100 - Importance:

High priority for utility revenue stability. - Rationale:

Ensures the customer pays regularly and on time.

2. Service Quality Score (25%)

- Formula:

100 - (Service Requests per Year × 5) + (Average Satisfaction Rating × 10) - Factors Included:

- Frequency of service requests

- Resolution time

- Customer satisfaction rating (assumed out of 10)

- Rationale:

Reflects the customer’s perception of service quality and efficiency.

3. Communication Responsiveness (15%)

- Formula:

(Responded Communications / Total Communications) × 100 - Rationale:

Measures engagement and willingness to interact with utility.

4. Account Longevity Factor (10%)

- Formula:

min(Account Age in Months / 60, 1) × 100 - Rationale:

Rewards loyalty; maxes out at 5 years (60 months).

5. Digital Engagement (5%)

- Formula:

(Digital Transactions / Total Transactions) × 100 - Rationale:

Encourages adoption of digital channels, improving efficiency.

6. Complaint Resolution Rate (5%)

- Formula:

(Resolved Complaints / Total Complaints) × 100 - Rationale:

Indicates how well the utility addresses customer concerns.

Penalty Factors

These are deductions from the total score:

- Late Payments: −2 points per occurrence

- Unresolved Complaints: −5 points each

- Service Disconnections: −10 points each

- Fraudulent Activity: −25 points

Score Ranges

- Account Age must be calculated from Connection Date (28 months from Jan 15, 2023)

Financial Information Rules:

- Payment compliance percentage must be calculated from successful payments vs total due (92%)

- Payment History must display chronologically with most recent first

- Payment amounts must show exact values ($120.45, $135.80, $105.25)

- Payment methods must reflect actual processing method (Credit Card, Bank Transfer)

- Payment status must indicate processing result (Processed for successful payments)

- Outstanding amount must calculate current balance minus payments received ($75.30)

- Average Monthly Usage must be calculated from historical consumption (4,500 gallons)

- Usage variance percentage must compare current vs previous period (-5% vs last year)

Service Connection Rules:

- Meter Number must be unique system identifier (M-5678)

- Device Number must correspond to physical meter device (D-9012)

- Meter Model must specify manufacturer and model (Aquaflow X200)

- Assignment Date must reflect meter installation date (Jan 10, 2023)

- Installation Date must be same as or after Assignment Date (Jan 15, 2023)

- Reading Status must indicate validation state (Active for operational meters)

- Last Reading must show most recent consumption with date (12580 gallons, Apr 15, 2025)

- Monthly readings must be listed chronologically in descending order

- Reading values must show progressive consumption (12580, 11350, 10100, 9050, 7980, 6800 gallons)

- All readings must have verification status (Verified for accepted readings)

Service Management Rules:

- Service Order numbers must follow sequential format (SO-4523, SO-4487)

- Service Order types must be predefined categories (Meter Reading, Maintenance)

- Service Order status must indicate completion state (Completed, In Progress, Scheduled)

- Request IDs must follow format REQ-XXXX (REQ-3245, REQ-3112, REQ-2987)

- Request types must be categorized (Transfer, Disconnection, Reconnection)

- Request status must reflect processing stage (In Progress, Scheduled, Completed)

Communication and Documentation Rules:

- Communication entries must include timestamp with AM/PM format (10:23 AM, 2:15 PM)

- Communication types must be categorized with appropriate icons (Email, Phone, SMS)

- Communication direction must be specified (To Customer, From Customer)

- Document types must be predefined categories (Service Agreement, Billing Authorization, Water Quality Report)

- Document verification status must be tracked (Verified, Published, Processing)

- Document dates must reflect actual document creation or submission dates

- Complaint numbers must follow format C-XXXX (C-3245, C-2987)

- Complaint status must indicate resolution state (Resolved for completed complaints)

Consumer Notes Rules:

- Notes must include author identification and timestamp

- Note content must be free-form text with character limits

- Notes must be displayed chronologically with most recent first

- System must track note creation date and time (May 20, 2025; May 18, 2025)

- Note authors must be identifiable system users (Jane Smith, Robert Johnson)

Activity Timeline Rules:

- Activity categories must be filterable (All, Payments, Billing, Service, Communication, Account)

- Activity entries must include precise timestamps (Apr 20, 2025 at 2:45 PM)

- Activity descriptions must provide specific details (Payment of $120.45 processed via Credit Card)

- Activity attribution must specify system or user origin (By: System, By: James Wilson)

- Payment activities must include amount and payment method details

- Bill generation activities must specify bill amount and period (Monthly bill of $120.45 for April 2025)

- Contact updates must specify what changed (Phone number updated from (555) 123-4567 to (555) 987-6543)

Validation Rules:

- Consumer creation requires mandatory fields: name, account number, service address

- Account numbers must be unique across the system

- Email addresses must follow valid email format

- Phone numbers must follow standard formatting

- Service addresses must be validated against service territory

- Balance amounts must be numeric with two decimal places

- Meter readings must be sequential and increasing values

- Date fields must follow MM/DD/YYYY format

- Percentage calculations must be rounded to whole numbers for display

8. Sample Data

Consumer Dashboard Metrics:

- Total Accounts: 7

- Active Accounts: 4 (57% of Total Accounts)

- Inactive Accounts: 1 (14% of Total Accounts)

- Temporarily Disconnected: 1 (14% of Total Accounts)

- Total Balance: $2044.50

Consumer List Sample:

- David Miller (david.miller@example.com)

- Account: WU-10007, Address: 246 Elm St, Anytown

- Status: Disconnected, Balance: $389.30, Payment: Collection

- Last Contact: 3/1/2025

- Jane Smith (jane.smith@example.com)

- Account: WU-10002 ⭐, Address: 456 Oak Ave, Anytown

- Status: Active, Balance: $0.00, Payment: Current

- Last Contact: 5/15/2025

- John Doe (john.doe@example.com)

- Account: WU-10001, Address: 123 Main St, Anytown

- Status: Active, Balance: $120.45, Payment: Current

- Last Contact: 5/10/2025

Consumer Profile Details (John Doe - WU-10001):

- Contact Information:

- Email: john.doe@example.com

- Phone: (555) 123-4567

- Service Address: 123 Main St, Anytown

- Billing Address: 456 Finance Ave, Billtown

- Account Information:

- Consumer Number: WU-10001

- Category: Residential

- Sub Category: Single Family

- Connection Date: Jan 15, 2023

- Plan: Standard Residential

- Payment Details:

- Current Balance: $75.30

- Last Payment: $120.45 (Apr 20, 2025)

- Payment Mode: Auto-pay (Credit Card)

- Next Payment Due: May 15, 2025

- Outstanding: $75.30

- Payment Compliance: 92%

Service Connection Data:

- Water Service: Active

- Meter Details:

- Meter No: M-5678

- Device No: D-9012

- Meter Type: Smart Water Meter

- Model: Aquaflow X200

- Assignment Date: Jan 10, 2023

- Installation Date: Jan 15, 2023

- Reading Status: Active

- Last Reading: 12580 gallons (Apr 15, 2025)

Monthly Meter Readings:

- Apr 15, 2025: 12580 gallons (Verified)

- Mar 15, 2025: 11350 gallons (Verified)

- Feb 15, 2025: 10100 gallons (Verified)

- Jan 15, 2025: 9050 gallons (Verified)

- Dec 15, 2024: 7980 gallons (Verified)

- Nov 15, 2024: 6800 gallons (Verified)

Service Orders:

- SO-4523: Apr 15, 2025 - Meter Reading (Regular monthly reading) - Completed

- SO-4487: Mar 22, 2025 - Maintenance (Check for leak) - Completed

Payment History:

- Apr 15, 2025: PAY-10045 - $120.45 - Credit Card - Processed

- Mar 15, 2025: PAY-9923 - $135.80 - Bank Transfer - Processed

- Feb 15, 2025: PAY-9632 - $105.25 - Credit Card - Processed

9. Acceptance Criteria

- The system must display accurate dashboard metrics including Total Accounts (7), Active Accounts (4), Inactive Accounts (1), and Temporarily Disconnected (1) with correct percentages

- The system must provide search functionality across consumer name, account number, phone, email, and address fields

- The system must support filtering, sorting, and display customization options for the consumer list

- The system must display consumer profile with complete account information including contact details, account information, and payment details

- The system must show current balance ($75.30), last payment amount, and payment compliance percentage (92%)

- The system must display service connection details including meter information, readings, and connection status

- The system must provide tabbed navigation for Overview, Financial, Connections, Service, Complaints, Requests, Communication, Documents, Notes, and Activity sections

- The system must show relationship health score (85/100) with account age and payment compliance metrics

- The system must display consumption charts for the last 6 months with service type selection

- The system must provide payment history table with dates, payment numbers, amounts, methods, and status

- The system must show billing overview with rate plan, billing cycle, payment method, and average monthly usage

- The system must display meter readings chronologically with reading values and verification status

- The system must provide service order management with creation capabilities and status tracking

- The system must support service request management with different request types and status indicators

- The system must maintain communication history across all channels (email, phone, SMS) with timestamps

- The system must provide document repository with verification status and document type categorization

- The system must support consumer notes with author identification and timestamps

- The system must display activity timeline with category filters and detailed activity descriptions

- The system must provide quick actions including Update Profile, Quick Actions dropdown, and context-sensitive buttons

- The system must show appropriate status indicators and alert notifications (payment due alerts, maintenance notifications)

10. Process Changes

Current Process | New Process | Impact |

|---|---|---|

Manual navigation through multiple screens to gather consumer information | Unified consumer profile dashboard with all information in one interface | 70% reduction in information gathering time and improved service quality |

Limited visibility into consumer account status and payment compliance | Comprehensive dashboard with real-time metrics and relationship health scoring | 50% improvement in proactive account management and customer retention |

Fragmented communication history across different systems | Centralized communication timeline with multi-channel integration | 60% reduction in response time and improved communication continuity |

Manual tracking of service requests and orders without status visibility | Automated service management with real-time status updates and workflow integration | 45% improvement in service completion rates and customer satisfaction |

Separate systems for financial, service, and communication management | Integrated consumer management platform with cross-functional visibility | 80% reduction in system switching and improved operational efficiency |

Reactive customer service based on incomplete information | Proactive service delivery with comprehensive consumer insights and predictive indicators | 35% increase in first-contact resolution and customer satisfaction scores |

Manual document management with limited tracking capabilities | Digital document repository with verification status and automated categorization | 90% reduction in document processing time and improved compliance tracking |

Basic search functionality limited to primary identifiers | Advanced search across multiple consumer attributes with filtering and sorting | 65% improvement in account discovery efficiency and reduced call handling time |

Impact percentages are estimated based on typical utility industry benchmarks for similar system implementations. Actual results may vary based on specific organizational factors and implementation approaches.

11. Impact from Solving This Problem

Metric | Improvement Impact |

|---|---|

Customer Service Efficiency | 70% reduction in information gathering time through unified consumer profiles |

First Contact Resolution Rate | 35% increase due to comprehensive customer context and quick action capabilities |

Customer Satisfaction Scores | 40% improvement through faster response times and personalized service delivery |

Service Request Processing Time | 45% reduction through automated workflows and real-time status tracking |

Payment Collection Efficiency | 25% improvement in collection rates through better visibility into payment patterns and compliance metrics |

Communication Response Time | 60% faster response through centralized communication history and context |

Document Processing Efficiency | 90% reduction in document handling time through digital repository and automated verification |

Account Management Productivity | 50% increase in accounts managed per representative through streamlined interface and bulk operations |

System Navigation Time | 80% reduction in time spent switching between multiple systems |

Data Accuracy and Consistency | 95% improvement through centralized data management and real-time synchronization |

12. User Behavior Tracking

Customer Service Representatives

Event | Properties | Metrics | Insights |

|---|---|---|---|

Consumer_Search | search_term, search_type, results_count, time_spent | Search effectiveness, Common search patterns | What are the most common ways representatives find consumer accounts? |

Consumer_Profile_View | consumer_id, view_duration, tabs_accessed, actions_taken | Profile engagement, Information consumption patterns | Which profile sections are most valuable for customer service? |

Quick_Action_Usage | action_type, consumer_id, completion_time, success_rate | Action efficiency, Most used actions | What quick actions provide the most value and should be prioritized? |

Communication_History_Access | consumer_id, communication_type, search_filters, time_spent | Communication review patterns | How do representatives use communication history for customer context? |

Service_Order_Creation | consumer_id, order_type, creation_time, completion_status | Service order efficiency, Order type distribution | What types of service orders are created most frequently? |

Recovery Executives

Event | Properties | Metrics | Insights |

|---|---|---|---|

Collection_Account_Review | consumer_id, balance_amount, compliance_score, time_spent | Collection prioritization patterns | How are high-risk accounts being identified and prioritized? |

Payment_History_Analysis | consumer_id, analysis_duration, payment_patterns_identified | Payment pattern recognition | What payment behaviors indicate collection risk? |

Collection_Activity_Log | consumer_id, activity_type, outcome, follow_up_scheduled | Collection activity effectiveness | Which collection strategies produce the best results? |

Compliance_Metric_Review | consumer_id, compliance_percentage, trend_analysis | Compliance monitoring patterns | How are compliance trends used for collection strategy? |

Questions Answered by Tracking:

- What consumer information is accessed most frequently during service interactions?

- Which quick actions reduce average call handling time most effectively?

- How does comprehensive consumer profile access impact first-contact resolution rates?

- What communication history patterns correlate with successful issue resolution?

- Which consumer segments require the most service attention and resources?

- How do collection activities correlate with payment compliance improvements?

- What profile sections contribute most to customer satisfaction improvements?

- Which search methods are most effective for different types of service inquiries?

13. Wireframe

https://preview--utility-compass-flow-13.lovable.app/consumers/new-application