Account Transfer Request

1. Problem Statement

User Roles

Based on the current system limitations and user personas, three distinct user roles are affected:

- Customer Executive - Handles walk-in customers at service centers

- Call Center Representative - Manages incoming customer calls

- Utility Administrator - Configures system settings and manages workflows

Pain Points

Customer Executive:

- Cannot process account transfer requests for walk-in customers requiring immediate service

- Lacks proper verification workflow for identity validation during transfers

- No standardized documentation process for transfer requests

- Unable to generate receipts or confirmations for customers

- Manual workarounds create inconsistent service delivery

Call Center Representative:

- No digital workflow to handle account transfer requests over the phone

- Cannot track status of transfer requests for customer follow-up

- Lacks proper approval routing for complex transfer scenarios

- No integration with verification systems for remote identity confirmation

- Unable to provide customers with tracking numbers or status updates

Utility Administrator:

- No centralized visibility into transfer request volumes and processing times

- Cannot configure business rules for different transfer scenarios

- Lacks reporting capabilities for transfer request analytics

- No standardized approval workflows for different transfer types

- Unable to monitor system performance for transfer processing

Core Problem

The utility lacks a comprehensive account transfer request system that enables customers to transfer utility accounts between parties with proper verification, approval workflows, documentation, and receipt generation, resulting in manual processes, inconsistent service delivery, and poor customer experience.

2. Who Are the Users Facing the Problem?

Customer Executive

- Responsibilities: Handles walk-in customers, processes account changes, manages complex transactions requiring verification

- Access Level: Should have full access to create, process, and complete transfer requests with document management capabilities

Call Center Representative

- Responsibilities: Manages phone-based customer interactions, creates service orders, handles billing inquiries

- Access Level: Should have access to create and track transfer requests with limited approval capabilities for simple transfers

Utility Administrator

- Responsibilities: Configures system settings, manages workflows, oversees business process alignment

- Access Level: Should have administrative access to configure transfer rules, approval workflows, and generate reports

3. Jobs To Be Done

For Customer Executive: When I need to process an account transfer for a walk-in customer, But I have no systematic way to verify identities, route approvals, and generate proper documentation, Help me create a guided transfer workflow with integrated verification and receipt generation, So that I can provide consistent, compliant service while reducing processing time and improving customer satisfaction.

For Call Center Representative: When I need to handle account transfer requests over the phone, But I cannot create digital requests, track their status, or provide customers with confirmation details, Help me initiate transfer requests with proper documentation and status tracking capabilities, So that I can provide professional service and keep customers informed throughout the process.

For Utility Administrator: When I need to ensure transfer requests are processed consistently and efficiently across all channels, But I have no visibility into request volumes, processing times, or bottlenecks, Help me configure automated workflows with proper approval routing and comprehensive reporting, So that I can optimize operations and ensure regulatory compliance.

4. Solution

A comprehensive Account Transfer Request Management System within SMART360 that provides end-to-end workflow automation from request creation through approval and completion.

Key Capability Areas

Request Creation & Intake

- Multi-channel request initiation (in-person, phone, online)

- Guided workflow with required field validation

- Document upload and scanning capabilities

Identity Verification & Documentation

- Integrated ID scanning and verification

- Digital signature capture

- Photo documentation capabilities

Approval Workflow Management

- Configurable approval routing based on transfer type

- Automated notifications and status updates

- Escalation procedures for complex cases

Payment & Fee Processing

- Transfer fee calculation and collection

- Multiple payment method support

- Automated receipt generation

Account Management Integration

- Seamless integration with existing customer accounts

- Automatic account closure and new account creation

- Billing cycle coordination

Communication & Notifications

- Automated status notifications to all parties

- SMS and email communication templates

- Customer portal integration for status tracking

Reporting & Analytics

- Transfer volume and processing time reports

- Approval bottleneck analysis

- Customer satisfaction tracking

Audit Trail & Compliance

- Complete transaction history logging

- Regulatory compliance documentation

- Data retention and archival capabilities

Document Management

- Centralized document storage

- Template management for forms

- Electronic signature integration

Mobile Workforce Support

- Field technician access for service transfers

- Mobile document capture

- Offline capability for remote locations

5. Major Steps Involved

Customer Executive Flow

- Request Initiation

- Log into SMART360 customer service module

- Navigate to "Account Transfer" section

- Click "New Transfer Request"

- Select transfer type (Individual to Individual, Individual to Business, etc.)

- Customer Information Collection

- Scan or manually enter current account holder ID

- Verify account details against system records

- Collect new account holder information

- Upload required documentation (ID, proof of ownership, etc.)

- Verification Process

- Use integrated ID scanner to verify both parties

- Capture digital signatures on transfer agreement

- Take photos of supporting documents

- Complete identity verification checklist

- Transfer Details Configuration

- Select effective transfer date

- Configure billing cycle alignment

- Calculate and collect transfer fees

- Process payment through integrated system

- Review and Submission

- Review all entered information for accuracy

- Generate preview of transfer documents

- Submit for approval workflow

- Provide customer with receipt and tracking number

- Status Monitoring

- Access transfer request dashboard

- Monitor approval status in real-time

- Respond to approval requests or questions

- Notify customer of completion

Call Center Representative Flow

- Call Handling Setup

- Receive customer call requesting account transfer

- Authenticate customer using security questions

- Access customer account in SMART360

- Navigate to transfer request module

- Information Gathering

- Complete guided transfer interview

- Collect new account holder information over phone

- Document transfer reason and effective date

- Explain required documentation and next steps

- Request Creation

- Create transfer request with collected information

- Mark as "Pending Documentation" status

- Generate required document list for customer

- Schedule document collection appointment if needed

- Documentation Management

- Receive documents via email, fax, or in-person visit

- Update request status as documents are received

- Route to appropriate approval level

- Communicate status updates to customer

- Follow-up Activities

- Monitor request progress in queue

- Respond to customer status inquiries

- Coordinate with field teams for service transfers

- Confirm completion with all parties

Utility Administrator Flow

- System Configuration

- Access SMART360 administration panel

- Configure transfer request types and requirements

- Set up approval workflow routing rules

- Define fee structures and payment options

- Workflow Management

- Monitor transfer request queue dashboard

- Review approval bottlenecks and processing times

- Adjust routing rules based on volume patterns

- Configure automated notification templates

- Reporting and Analytics

- Generate transfer volume reports

- Analyze processing time metrics

- Review customer satisfaction scores

- Create executive dashboards

- Quality Assurance

- Audit completed transfer requests

- Review compliance with regulatory requirements

- Monitor system performance metrics

- Implement process improvements

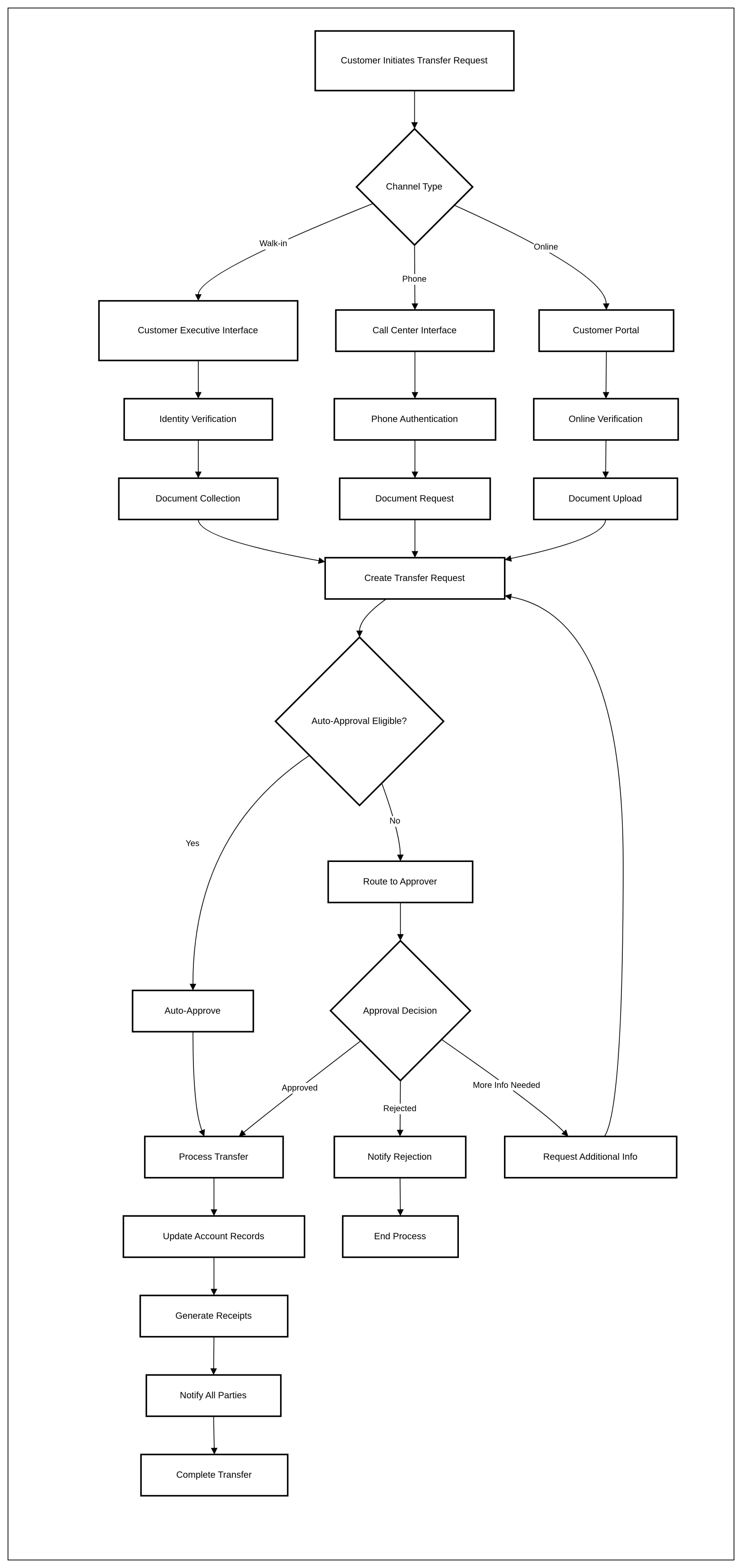

6. Flow Diagram

Primary Transfer Request Flow

Approval Workflow

7. Business Rules

Create transfer Request

Consumer Search - Step 1

- Consumer can be search by the name and account number

- Consumer details appear below after selection

Transfer Type & Schedule - Step 2

Select Transfer Type

- Field is required

- Transfer type will come from settings, transfer types

- Must select from available transfer type options

Effective Date

- Field is required

- Must select a valid future date

- Date picker format required

New Account Holder Information

First Name

- Field is required

- Text input only

- Cannot be empty

Last Name

- Field is required

- Text input only

- Cannot be empty

Email Address

- Field is required

- Must be valid email format

- Cannot be empty

Phone Number

- Field is required

- Must be valid phone number format

- Cannot be empty

Relationship to Current Customer

- Field is required

- Must select from dropdown options

- Spouse

- Child

- Parent

- Sibling

- Business partner

- Other

- Cannot be left unselected

Billing Address

Change Billing Address

Transfer Settings

Financial Responsibility

Special Instructions

- Optional text field

- Free text entry allowed

- No character limit specified

Documentation - Step 3

- All the Document types should be visible

- Non mandatory fields

- User can add multiple sub documents types under one document type

Review and Submit - Step 4

Account Information Rules

- Current account holder name and account number are required

- Service address must be provided for the current account

- Outstanding balance must be displayed and tracked

New Account Holder Rules

- New account holder name is required

- Email and phone number are marked as "Not specified" but appear to be optional fields

- Relationship field is required (shows "Not Specified" status)

Transfer Configuration Rules

- Billing address defaults to existing service address

- Financial responsibility for outstanding balance transfers to the new account holder

Documentation Rules

- Documents are required before transfer can be processed

- Zero documents uploaded will prevent transfer completion

- Missing documentation may delay the transfer process

Financial Rules

- Outstanding balance of $245.78 must be transferred to the new account holder

- Balance transfer details must specify the effective date when new account holder assumes responsibility

- Outstanding balance alert must be displayed prominently

Submission Rules

- "Submit Request" button is only enabled when all required fields are completed

- "Save Draft" option is available for incomplete requests

- Previous step navigation is allowed during the process

- A receipt should be generated with all the transfer information.

- Can be downloaded or printed.

- User can another transfer request and can returned to dashboard

Request Detail view

- Transfer ID must be system generated

- Transfer type, and created date should be displayed

- Acknowledgement button - when it is clicked then the status of the request should be change to in-progress. the button becomes "put on hold", if its click then the status of the request is "on hold" and the button becomes "resume", on clicking on resume the status of the request is again "In- progress".

- consumer name should be displayed with a vip badge of vip.

- consumer account no should be displayed below name

- request priority and status should be displayed below account no.

- Sla status - its "on track" if all sla metrics fall in the sla rules and "breached' if not.

- SLA due date - calculate from the date of creation adding the resolution time defined.

- time remaining - calculated from the current time - resolution time

requet details card

- Request ID - auto generated

- Created on

- created by

- last updated on

- last updated by

Consumer information

- phone

- consumer category

- consumer sub category

- service address

- billing address

Quick actions

- send response to consumer - redirect to individual messaging in communication module

- Create service order - redirect in the below service order tab.

- Add internal note - redirect in the below communication tab

- Approve request - Redirect to the details tab requirement checklist

- Reject request - dialog box is open and the reason textbox is asked and then request is closed.

Details Tab

Request Information Rules

- Code, display the selected transfer type code

- Transfer type must be specified

- Change billing address option must be indicated (Yes/No)

- Description field is required to explain the reason for transfer, will come from the selected transfer type

SLA Target & SLA Achieved

SLA Target

- Fixed SLA thresholds set in system settings by utility (per request type).

- Acknowledgement: 2 hrs

- Response: 4 hrs

- Resolution: 24 hrs

SLA Achieved

- Auto-calculated in real-time:

- Based on timestamps of acknowledgement, first action, and final resolution.

- If resolution is not yet done, show Pending.

- Displayed in hours with 2-decimal precision

New Account Holder Information Rules

- Name is required

- Phone number is required in format (XXX) XXX-XXXX

- Email address is required in valid email format

- Relation to current account holder is required

Account Balance Rules

- Outstanding amount must be displayed

- Last payment amount must be shown

- Last payment date must be recorded

Document Upload Rules

- All submitted documents will be visible

- User can view the document

- All document is must be verified

- All uploaded documents must include upload date (2025-05-18)

Requirements Checklist Rules

- Proof of Identity must be completed

- Proof of Address must be completed

- Transfer Authorization must be completed

- Financial Verification must be completed

Special Instructions Rules

- Special instructions field will come from the add request form

Final Action Rules

- "Reject Request" option must be available

- "Approve Transfer" option must be available

- Both actions are mutually exclusive

- On the approval the Details of the account will be changed by the new details, including the documents.

Service order tab

- service order type - display only the templates which are associated with consumer

- Scheduled date - date picker

- remarks - text box

- add service order button - create the service order

- Existing service order

- SO no

- so name

- SO status

- Schedule date

- Created on

- Created by

- assigned to, assigned on

- remark

- view details - redirect to so detail view

- download report - download if the service order is completed

communication tab

- All the communication sent to consumer or internal notes are displayed here

- user can add a note by selecting internal or consumer

Timeline tab

- All the Request related activities are tracked and log

status lifecycle

- Pending - when it is created

- In progress - when it is acknowledge

- on hold - when put on hold

- completed - when mark as resolved

- Rejected - When marked as rejected

Landing Page

KPIs

- Pending transfer - number of total request excluding the completed and rejected status

- Completed this month - number of completed status request for the current month

- Avg processing time - time between submitted date to completion date

- Success rate - completed request / total request * 100

Tabs

- Current transfer - request excluding reject and completed status

- Transfer history - request reject and completed status

Search bar

- Can search by transfer id, customer name, account number,

Filter

- Transfer type

- Date

- Status

- Priority

List view

- Transfer ID

- Customer name

- Account number

- Transfer type

- Request date

- Status

- Financial status - if outstanding is there then “Outstanding” or display “clear” if no outstanding

- Priority

- Action (View, download, print)

8. Sample Data

Sample Transfer Request

Request ID: TR-2025-001234

Request Date: 2025-06-05

Transfer Type: Ownership Transfer

Transfer Type Code: OT-001 Effective Date: 2025-06-15

Status: In Progress Priority: High VIP Status: Yes

Current Account Holder:

- Name: John Smith (VIP Badge)

- Account Number: 12345678

- Service Address: 123 Main St, Pune, Maharashtra 411001

- Billing Address: 123 Main St, Pune, Maharashtra 411001

- Consumer Category: Residential

- Consumer Sub Category: Premium

- Phone: +91-9876543210

- Email: john.smith@email.com

New Account Holder:

- First Name: Mary

- Last Name: Johnson

- Phone: (987) 654-3210

- Email: mary.johnson@email.com

- Relationship to Current Customer: Spouse

Account Balance Information:

- Outstanding Amount: ₹245.78

- Last Payment Amount: ₹1,250.00

- Last Payment Date: 2025-05-20

Transfer Settings:

- Change Billing Address: No, keep existing address

- Financial Responsibility: Transfer outstanding balance

- Special Instructions: Property sale to family member, urgent processing required

SLA Information:

- Acknowledgement Target: 2 hrs | Achieved: 1.5 hrs

- Response Target: 4 hrs | Achieved: Pending

- Resolution Target: 24 hrs | Due: 2025-06-06 14:30

- Time Remaining: 18.5 hrs

- SLA Status: On Track

Requirements Checklist:

- Proof of Identity: ✅ Verified

- Proof of Address: ✅ Verified

- Transfer Authorization: ✅ Verified

- Financial Verification: ⏳ Pending

Uploaded Documents:

- Aadhaar Card (Current Holder) - Uploaded: 2025-05-18

- Aadhaar Card (New Holder) - Uploaded: 2025-05-18

- Property Sale Deed - Uploaded: 2025-05-18

- Marriage Certificate - Uploaded: 2025-05-18

Workflow History:

- Created: 2025-06-05 08:00 by Customer Executive (CE001)

- Acknowledged: 2025-06-05 09:30 by Supervisor (SUP001)

- Documents Verified: 2025-06-05 10:15 by Document Reviewer (DR001)

- Status: In Progress

Service Orders:

- SO-2025-001: Meter Reading Verification | Scheduled: 2025-06-07 | Status: Pending

Sample Landing Page Data

KPIs:

- Pending Transfers: 45

- Completed This Month: 128

- Avg Processing Time: 18.5 hours

- Success Rate: 94.2%

Filter Options:

- Transfer Types: Ownership Transfer, Tenant Transfer, Business Transfer, Emergency Transfer

- Date Range: Last 7 days, Last 30 days, Custom range

- Status: Pending, In Progress, On Hold, Completed, Rejected

- Priority: Low, Medium, High, Critical

9. Acceptance Criteria

- The system must allow users to search consumers by name and account number with auto-suggestions appearing below the search field

- The system must require selection of transfer type from a dropdown populated from system settings and prevent form submission without selection

- The system must require effective date selection using a date picker that only allows valid future dates

- The system must require first name and last name fields for new account holder with text input validation and no empty values allowed

- The system must validate email address format and require phone number in proper format for new account holder

- The system must require relationship selection from predefined dropdown options (Spouse, Child, Parent, Sibling, Business partner, Other)

- The system must present billing address change as radio button selection with "Yes, display address box" or "No, keep existing address" options

- The system must require financial responsibility selection with radio buttons for "Transfer outstanding balance" or "Clear balance before transfer" with "Transfer outstanding balance" as default

- The system must display all document types as non-mandatory fields allowing multiple sub-document uploads under each document type

- The system must display current account holder name, account number, service address, and outstanding balance in the review section

- The system must show new account holder information with required field validation and "Not specified" status for incomplete fields

- The system must display outstanding balance prominently with transfer responsibility details and effective date

- The system must require document uploads before transfer completion and prevent submission with zero documents uploaded

- The system must enable "Submit Request" button only when all required fields are completed and provide "Save Draft" option for incomplete requests

- The system must generate a receipt with all transfer information that can be downloaded or printed upon submission

- The system must generate unique system transfer IDs and display transfer type and creation date in request detail view

- The system must provide acknowledgement button that changes request status to "in-progress" and toggles to "put on hold"/"resume" functionality

- The system must display consumer name with VIP badge if applicable, account number, request priority, and status

- The system must calculate and display SLA status as "on track" or "breached" based on defined SLA rules with due date and time remaining

- The system must show request details card with auto-generated Request ID, creation/update timestamps, and user information

- The system must display consumer information including phone, email, consumer category, service address, and billing address

- The system must provide quick actions for sending consumer responses, creating service orders, adding internal notes, approving/rejecting requests

- The system must show SLA targets (Acknowledgement: 2 hrs, Response: 4 hrs, Resolution: 24 hrs) and real-time achieved times with 2-decimal precision

- The system must display new account holder information with required name, formatted phone number, valid email, and relationship fields

- The system must show account balance with outstanding amount, last payment amount, and last payment date

- The system must display all uploaded documents with upload dates and verification status, allowing document viewing

- The system must show requirements checklist with completion status for Proof of Identity, Proof of Address, Transfer Authorization, and Financial Verification

- The system must provide service order tab with templates associated with consumer, date picker for scheduling, and remarks text box

- The system must display existing service orders with SO number, name, status, schedule date, creation details, assignment info, and action buttons

- The system must provide communication tab displaying all consumer and internal communications with ability to add new notes

- The system must show timeline tab tracking all request activities with status lifecycle (Pending → In Progress → On Hold → Completed/Rejected)

- The system must display landing page KPIs including pending transfers, completed this month, average processing time, and success rate percentage

- The system must provide tabs for current transfers (excluding rejected/completed) and transfer history (rejected/completed only)

- The system must allow search by transfer ID, customer name, and account number with auto-complete functionality

- The system must provide filters for transfer type, date range, status, and priority with multi-select capability

- The system must display list view with Transfer ID, customer name, account number, transfer type, request date, status, and financial status (Outstanding/Clear)

- The system must update account details with new account holder information including documents upon transfer approval

- The system must prevent approval/rejection actions until all requirements checklist items are verified and completed

- The system must calculate success rate as (completed requests / total requests) × 100 with proper percentage formatting

- The system must maintain audit trail of all status changes, user actions, and timestamps in the timeline tab

10. Process Changes

Process Area | From | To | Impact |

|---|---|---|---|

Request Initiation | Manual paper forms filled out by customers, prone to errors and illegible handwriting | Digital guided workflow with validation and auto-completion | 60% reduction in data entry errors, 40% faster initial processing |

Identity Verification | Manual visual inspection of IDs, photocopying documents | Integrated ID scanning with automated verification against government databases | 80% reduction in fraudulent transfers, 90% faster verification process |

Approval Routing | Phone calls and emails to find available approvers, manual tracking | Automated routing based on business rules with real-time notifications | 75% reduction in approval delays, 50% faster overall processing |

Document Management | Physical file storage, manual organization, risk of loss | Electronic document storage with automatic categorization and retrieval | 100% elimination of lost documents, 70% reduction in storage costs |

Payment Processing | Separate manual payment processing, multiple receipt systems | Integrated payment with automatic receipt generation and accounting updates | 85% reduction in payment processing errors, instant reconciliation |

Status Tracking | Manual phone calls to check status, no self-service options | Real-time status dashboard with automated notifications | 90% reduction in status inquiry calls, improved customer satisfaction |

Communication | Manual phone calls and letters for updates | Automated SMS, email, and portal notifications | 95% faster communication delivery, 60% improvement in customer response rates |

Reporting | Manual compilation of transfer data from multiple sources | Automated reports with real-time dashboards and analytics | 90% reduction in report preparation time, improved decision-making speed |

11. Impact from Solving This Problem

Metric Category | Specific Metric | How It Improves |

|---|---|---|

Operational Efficiency | Transfer Processing Time | Reduces from 10-15 business days to 3-5 business days through automation and streamlined workflows |

Customer Satisfaction | Transfer Request Resolution Rate | Increases from 75% to 95% due to better tracking and communication |

Cost Reduction | Administrative Processing Costs | Decreases by 50% through elimination of manual paperwork and duplicate data entry |

Error Reduction | Data Entry Error Rate | Reduces from 15% to 3% through automated validation and guided workflows |

Staff Productivity | Customer Executive Transaction Volume | Increases by 40% due to streamlined processes and reduced manual work |

Revenue Protection | Transfer Fee Collection Rate | Improves from 80% to 98% through integrated payment processing |

Compliance | Audit Trail Completeness | Achieves 100% documentation compliance with automated audit logging |

Customer Experience | Self-Service Adoption | Enables 60% of customers to track status independently, reducing call volume |

Risk Management | Identity Verification Success | Improves fraud prevention by 85% through automated ID verification |

Resource Utilization | Staff Time Allocation | Redirects 30% of administrative time to value-added customer service activities |

12. User Behavior Tracking

Customer Executive Tracking Plan

Event | Properties | Insights Gained |

|---|---|---|

transfer_request_initiated | user_id, channel, transfer_type, timestamp | How many transfers are initiated in-person vs other channels? |

id_verification_completed | verification_method, success_rate, time_taken | Which verification methods are most efficient and accurate? |

document_upload_attempted | document_type, file_size, success_rate | What document types cause the most upload issues? |

payment_processing_completed | payment_method, amount, processing_time | Which payment methods are preferred and most reliable? |

approval_request_submitted | approval_level, transfer_amount, time_to_submit | How long does it take staff to prepare requests for approval? |

Key Questions Answered:

- Which customer executives are most efficient at processing transfers?

- What are the common bottlenecks in the verification process?

- How can we optimize the document collection workflow?

Call Center Representative Tracking Plan

Event | Properties | Insights Gained |

|---|---|---|

phone_transfer_initiated | call_duration, customer_verification_time, completion_rate | How effective is phone-based transfer initiation? |

status_inquiry_received | request_age, inquiry_type, resolution_provided | What information do customers need most during the process? |

document_request_sent | delivery_method, response_time, completion_rate | Which document request methods are most effective? |

customer_callback_scheduled | reason, time_preference, completion_rate | How often do transfers require multiple customer interactions? |

transfer_completion_confirmed | total_process_time, customer_satisfaction, follow_up_needed | What factors contribute to successful transfer completion? |

Key Questions Answered:

- How can we reduce the number of customer contacts required per transfer?

- Which representatives handle complex transfers most effectively?

- What training needs exist for handling different transfer scenarios?

Utility Administrator Tracking Plan

Event | Properties | Insights Gained |

|---|---|---|

workflow_configuration_changed | rule_type, change_reason, impact_scope | How do business rule changes affect processing efficiency? |

approval_bottleneck_identified | approval_level, queue_size, avg_wait_time | Where are the systematic delays in the approval process? |

report_generated | report_type, frequency, stakeholder_access | Which metrics are most valuable for operational decision-making? |

system_performance_monitored | response_time, error_rate, user_satisfaction | How does system performance impact user adoption? |

compliance_audit_completed | audit_type, findings, remediation_required | Are we maintaining required regulatory compliance standards? |

Key Questions Answered:

- How can we optimize approval workflows to reduce processing time?

- Which configuration changes have the biggest impact on efficiency?

- What predictive indicators can help us prevent processing bottlenecks?

13. Wireframe

https://preview--utility-compass-flow-41.lovable.app/payments/new