User Story: Asset Portfolio Management Dashboard (AX01US01)

1. Problem Statement

The Asset Manager is tasked with long-term strategic planning for the utility's entire asset base but lacks a unified, real-time tool to do so effectively. This forces a reliance on manually compiled, often outdated, data from disparate systems.

Key Pain Points:

- Lack of a Strategic Overview: Inability to get a quick, consolidated view of portfolio health, risk, and financial standing.

- Inefficient Prioritization: Difficulty identifying which asset categories or age groups pose the most significant risk, leading to subjective investment decisions.

- Weak Justification for Investment: Struggling to build a data-driven business case for multi-million dollar capital requests without a clear link between asset condition and financial risk.

- Unclear Financial Outlook: Inability to quantify and track the "Investment Gap," which is the unfunded liability for replacing failing assets.

Core Problem: The absence of a single, strategic dashboard leads to reactive planning, inefficient capital allocation, and an inability to clearly communicate the financial and operational risks of aging infrastructure to executive stakeholders.

2. Who is the User Facing the Problem?

Primary User: Asset Manager

This individual is responsible for developing the utility's long-term asset management strategy. Their core duties include prioritizing capital investments, managing lifecycle costs, mitigating portfolio-wide risk, and reporting on asset performance to executive leadership. This dashboard is designed as their primary tool for strategic oversight.

3. Jobs To Be Done

For the Asset Manager:

When I need to develop the 5-year capital improvement plan,

But I can't easily visualize which assets are in the worst condition, pose the highest risk, and are driving our investment gap,

Help me by consolidating portfolio health, risk, and financial metrics into a single, interactive dashboard,

So that I can make defensible, data-driven decisions on where to allocate budget for maximum risk reduction and long-term value.

4. Solution

The solution is a strategic Asset Portfolio Dashboard that serves as a command center for the Asset Manager. It translates complex operational data into high-level, actionable insights for capital planning and risk management.

Key Capabilities:

- Strategic KPI Overview: Presents the most critical metrics at a glance: Asset Health Index, Average Remaining Useful Life (RUL), Overall Risk Score, and the Investment Gap.

- Portfolio Segmentation: Breaks down the portfolio by key strategic segments like Asset Category (e.g., Vertical, Horizontal) and Age Profile to quickly identify trends.

- Condition & Risk Visualization: Uses clear, color-coded charts to display the distribution of assets by Health Status (Good, Fair, Poor) and Risk Level (Low, Medium, High).

- Financial Impact Analysis: Features the "Investment Gap" as a core financial metric and tracks the "Emergency vs. Planned" work ratio to measure strategic effectiveness.

- Interactive Drill-Down: Allows the user to click on any data segment (e.g., "High Risk Assets") to filter the entire dashboard and investigate the root causes behind the numbers.

- Automated Watchlists: Surfaces contextual information like "Frequent Failure Assets" and "Overdue Inspections" to inform risk analysis.

- Export & Reporting: Enables one-click export of any dashboard view to PDF or CSV for use in reports and presentations.

5. Major Steps Involved (Asset Manager Workflow)

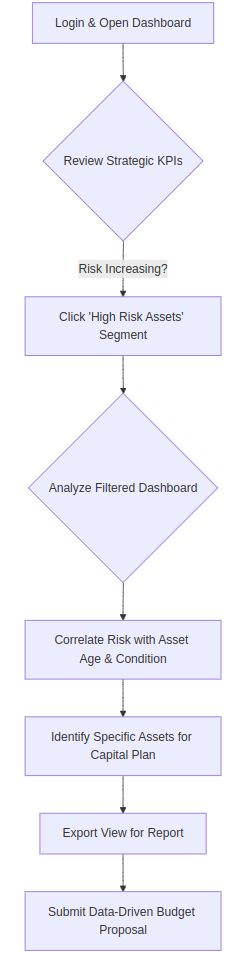

- Assess Portfolio: The Asset Manager opens the dashboard to begin their quarterly planning. They immediately review the four key KPIs at the top, noting an increase in the Overall Risk Score and the Investment Gap.

- Isolate Problem Area: They identify that 90 assets are categorized as "High Risk" and click on that segment to investigate further.

- Drill-Down Analysis: The entire dashboard filters to this high-risk segment. The manager can now clearly see that these assets are predominantly in the "> 20 years" age band and have a "Poor" health status.

- Formulate Strategy: The data provides a clear conclusion: a specific cohort of aging assets is driving portfolio risk. These 90 assets become the top priority for the upcoming capital plan.

- Justify the Plan: The Asset Manager exports the filtered dashboard view as a PDF. They use this visual evidence in their budget proposal to provide a data-driven justification for funding the replacement of these specific assets.

6. Flow Diagram

7. Business Rules

General Dashboard Business Rules

These rules apply to the entire dashboard.

- Default View: On loading, the dashboard will default to a "Year-to-Date" (YTD) view.

- Trend Indicators: All trend indicators (e.g., ↑ 2.1%) compare the metric's value for the currently selected date range against the value from the immediately preceding equivalent period.

- Example: If the view is "This Quarter," the trend compares against "Last Quarter." If the view is "YTD" as of July 16, 2025, the trend compares against the same date range from the previous year.

- Hover & Tooltips: Hovering over any interactive element (KPIs, chart segments, list items) will change the mouse cursor to a pointer and provide a subtle visual cue (e.g., the element brightens or a border appears). Every dynamic data element will have a tooltip on hover.

Filter Options

The dashboard must provide the following filtering capabilities, typically located in a header bar:

- Date Range Filter:

- Functionality: Allows the user to control the time period for which all dashboard data is displayed.

- Default Value: "Year-to-Date" (YTD).

- Options:

- This Month

- This Quarter

- Last Quarter

- This Year (YTD)

- Last 12 Months

- Custom Range (with a start and end date picker).

- Business Rule: All metrics, trends, and lists on the dashboard will recalculate based on the selected date range.

- Hierarchy Filter (Facilities, Systems, Networks):

- Functionality: Allows the user to narrow the dashboard view to a specific part of the asset portfolio.

- Options: A multi-select dropdown or a searchable tree view that lets the user select one or more:

- Facilities

- Systems

- Networks

- Business Rule: Selecting a Facility will automatically include all Systems and Assets within it. Selecting a System will include all its Assets. This provides a powerful way to analyze specific operational areas.

Detailed Business Rules by Dashboard Section

1. Top Navigation Tabs

These tabs suggest the dashboard is part of a larger application.

- Fields: Overview, Financial, O&M, Energy, Inventory, Compliance.

- Business Rules:

- The "Overview" tab is the currently selected view, displaying the Asset Portfolio Health & Condition dashboard.

- Each tab navigates the user to a different dashboard focused on that specific domain.

- The active tab must be visually distinct from the others (e.g., underlined, different color).

2. Strategic KPIs (Top Row)

This section provides a high-level summary of portfolio health.

Field Name | Business Rules & Formula | Tooltip Content |

|---|---|---|

Asset Health Index | Value (87): A calculated score representing the overall health of the entire asset portfolio. Formula: | Title: Asset Health Index Description: "A consolidated score from 0-100 indicating the overall health of the asset portfolio. It combines asset condition, age, and performance data." Formula: |

Total Assets | Value (1,247): A distinct count of all active assets in the portfolio. Formula: Trend (↑ 2.4%): Change in the total number of assets compared to the previous period. | Title: Total Assets Description: "The total number of active assets currently being managed in the portfolio." |

Avg RUL | Value (12.4 yrs): The average remaining useful life across all assets. | Title: Average Remaining Useful Life (RUL) Description: "The average number of years remaining before assets in the portfolio are expected to reach the end of their service life." Formula: |

Asset Availability | Value (91%): The percentage of time assets were operational and available to perform their function. | Title: Asset Availability |

Out of Service | Value (115): The count of assets currently in an "Out of Service" or "Inactive" status. | Title: Out of Service |

Inspection Compliance | Value (92%): The percentage of scheduled inspections that were completed on time. | Title: Inspection Compliance |

3. Asset Categories & Asset Age Profile

These widgets segment the portfolio for strategic analysis.

Widget / Field | Business Rules & Formula | Tooltip Content |

|---|---|---|

Asset Categories (Top 4) | A breakdown of the asset portfolio by pre-defined Class. Each category shows a count and its percentage of the total. | Title: Asset Class |

Asset Age Profile | A breakdown of the asset portfolio by age bands. Each band shows a count and its percentage of the total. | Title: Asset Age Profile |

4. Asset Health Status

This widget visualizes the current condition of the portfolio.

Field Name | Business Rules & Formula | Tooltip Content |

|---|---|---|

Good/Fair/Poor Condition | Each card represents a health status category. | Title: [Good/Fair/Poor] Condition |

5. Performance & Reliability

This section focuses on operational performance metrics.

Field Name | Business Rules & Formula | Tooltip Content |

|---|---|---|

Portfolio Failure Rate | Value (2.3%): The percentage of assets that experienced a failure during the period. | Title: Portfolio Failure Rate |

Avg MTBF | Value (720 hrs): Mean Time Between Failures. The average time an asset operates before it fails. | Title: Average Mean Time Between Failures (MTBF) |

Service Level Achievement | Value (91.5%): The percentage of time the utility met its defined service level targets (e.g., water pressure, flow rates).

| Title: Service Level Achievement |

Non-Revenue Water | Value (18.5%): The percentage of water produced that is lost before it reaches the customer. | Title: Non-Revenue Water (NRW) |

6. Frequent Failure Assets

This widget highlights problematic assets needing immediate attention.

- Business Rules:

- This list displays the top 3-5 assets with the highest number of failure-related work orders in the last 6 months.

- Each entry must display:

- Asset Name: The common name of the asset.

- Failure Count: "X failures in 6 months."

- Last Failure Date: The date of the most recent failure.

- The background color of the card indicates the asset's risk level (Red = High, Yellow = Medium).

- Action Button (Inspect): Navigate user to the detailed view of the asset

- Data Source: CMMS work order history, filtered for "corrective" or "failure" types.

- To identify these assets calculate the number of times the asset failed between preventive maintenance and display the top 5 in here

7. Risk & Strategic Impact

This section translates asset condition into financial and strategic risk.

Field Name | Business Rules & Formula | Tooltip Content |

|---|---|---|

Overall Risk Score | Value (6.2): The average risk score across all assets. | Title: Overall Risk Score <br> Description: "The primary indicator of portfolio vulnerability, tracking the effectiveness of risk mitigation strategies." <br> Formula: |

High-Risk Assets | Value (90): The count of assets classified with a "High" risk score. | Title: High-Risk Assets <br> Description: "The total number of assets that are classified as 'High Risk' based on their probability and consequence of failure." |

Investment Gap | Value ($2.8M): The unfunded liability for replacing assets in poor condition. | Title: Investment Gap |

Emergency vs Planned | Value (35:65): The ratio of Reactive/unplanned work orders to planned/preventive work orders. | Title: Emergency vs Planned Work |

8. Risk Assessment & Recently Added Assets

Widget / Field | Business Rules & Formula | Tooltip Content |

|---|---|---|

Risk Assessment | A breakdown of the portfolio by risk level. | Title: Risk Level |

Recently Added Assets | A chronological list of the 4-5 most recently added assets to the portfolio. | Title: Recently Added Asset |

9. Overdue Inspections

This widget is an action list for immediate operational attention.

- Business Rules:

- This list displays assets with inspections that are past their due date, ordered by urgency/risk.

- Each entry must display:

- Asset Name: The common name of the asset.

- Due Date: The date the inspection was due.

- Priority/Risk Level: A visual tag (e.g., "high," "medium," "low") indicating the risk associated with missing this inspection.

- Tooltip Content: On hover over an asset name: "This inspection is [X] days overdue. The priority is [High/Medium/Low].

8. Sample Data

Asset Name | Asset Category | Age (Yrs) | Condition | Risk Score | Replacement Cost |

|---|---|---|---|---|---|

Pump Station #7 | Vertical Asset | 22 | Poor | 8.5 | $250,000 |

Main Feeder Line B | Horizontal Asset | 35 | Poor | 9.2 | $1,200,000 |

Water Treatment Plant #1 | Facility | 25 | Poor | 8.1 | $5,000,000 |

Generator Unit A | Horizontal Asset | 18 | Fair | 6.5 | $150,000 |

9. Acceptance Criteria

- The system must display the four primary KPIs: Asset Health Index, Avg RUL, Overall Risk Score, and Investment Gap.

- The system must calculate the Investment Gap using the defined formula.

- The system must correctly categorize assets into the defined "Asset Categories" and "Asset Age Profile" bands.

- The system must display the total count and percentage of assets in "Poor Condition."

- The system must display the total count and percentage of assets at "High Risk."

- Clicking the "High Risk Assets" widget must filter all other widgets on the dashboard.

- Clicking the "Poor Condition" widget must filter all other widgets on the dashboard.

- The "Emergency vs Planned" work ratio must be displayed.

- Trend arrows next to each KPI must accurately compare the current period to the previous period.

- All KPIs must have a tooltip explaining the business meaning and calculation formula.

- The "Frequent Failure Assets" widget must list assets with the most failures in the last 6 months.

- The dashboard must provide an "Export to PDF" option.

- The dashboard must load completely within 5 seconds for a portfolio of up to 10,000 assets.

- The data on the dashboard must be refreshed at least once every 24 hours.

- All interactive elements must provide a visual cue on hover.

10. Process Changes

From (Current Process) | To (New Process) | Impact Analysis |

|---|---|---|

Spending days in spreadsheets to model risk and justify budgets. | Using the dashboard to instantly identify high-risk segments and quantify the investment gap. | Reduces annual capital planning preparation time by an estimated 30-40%, freeing up the manager for more strategic tasks. |

Budget meetings rely on anecdotal evidence and high-level summaries. | Budget meetings are driven by clear, visual data from the dashboard showing the link between risk, age, and funding. | Increases credibility and leads to more effective, data-driven capital allocation. |

Risk is assessed periodically as a major, time-consuming project. | Risk is monitored continuously via the "Overall Risk Score" KPI. | Enables agile strategy adjustments by showing the impact of investment decisions on risk in near real-time. |

11. Impact from Solving This Problem

Metric | How it Improves |

|---|---|

✅ Capital Budget Optimization | Ensures capital is allocated to assets that pose the greatest risk, maximizing the ROI of every dollar spent. |

✅ Proactive Risk Reduction | Focusing investment on "High Risk" assets demonstrably lowers the utility's operational and financial risk profile. |

✅ Strategic Alignment | Provides a clear, data-driven link between operations (asset condition) and financial strategy (capital planning). |

✅ Stakeholder Confidence | Builds confidence with the board and regulators by demonstrating a mature, data-driven approach to asset management. |

12. User Behavior Tracking

Question to Answer | Event to Track | Properties |

|---|---|---|

How often is the Asset Manager monitoring the portfolio? |

|

|

What strategic segments are being investigated most? |

|

|

Are the KPI definitions clear and being used? |

|

|

Is the dashboard being used to create reports? |

|

|

What is the typical analysis path for the manager? |

|

|